Configure Products

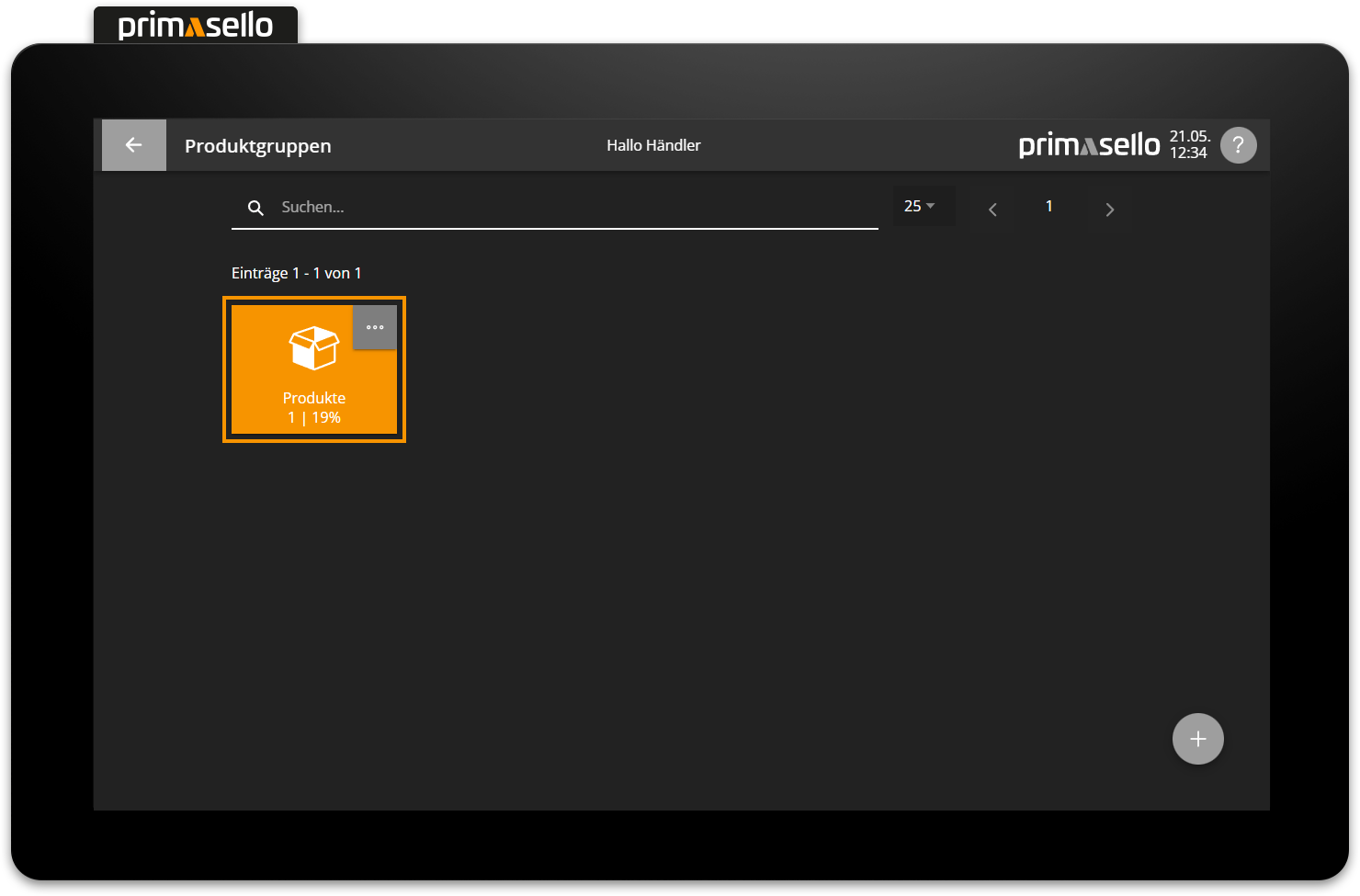

To access the products in a product group, press the desired product group button.

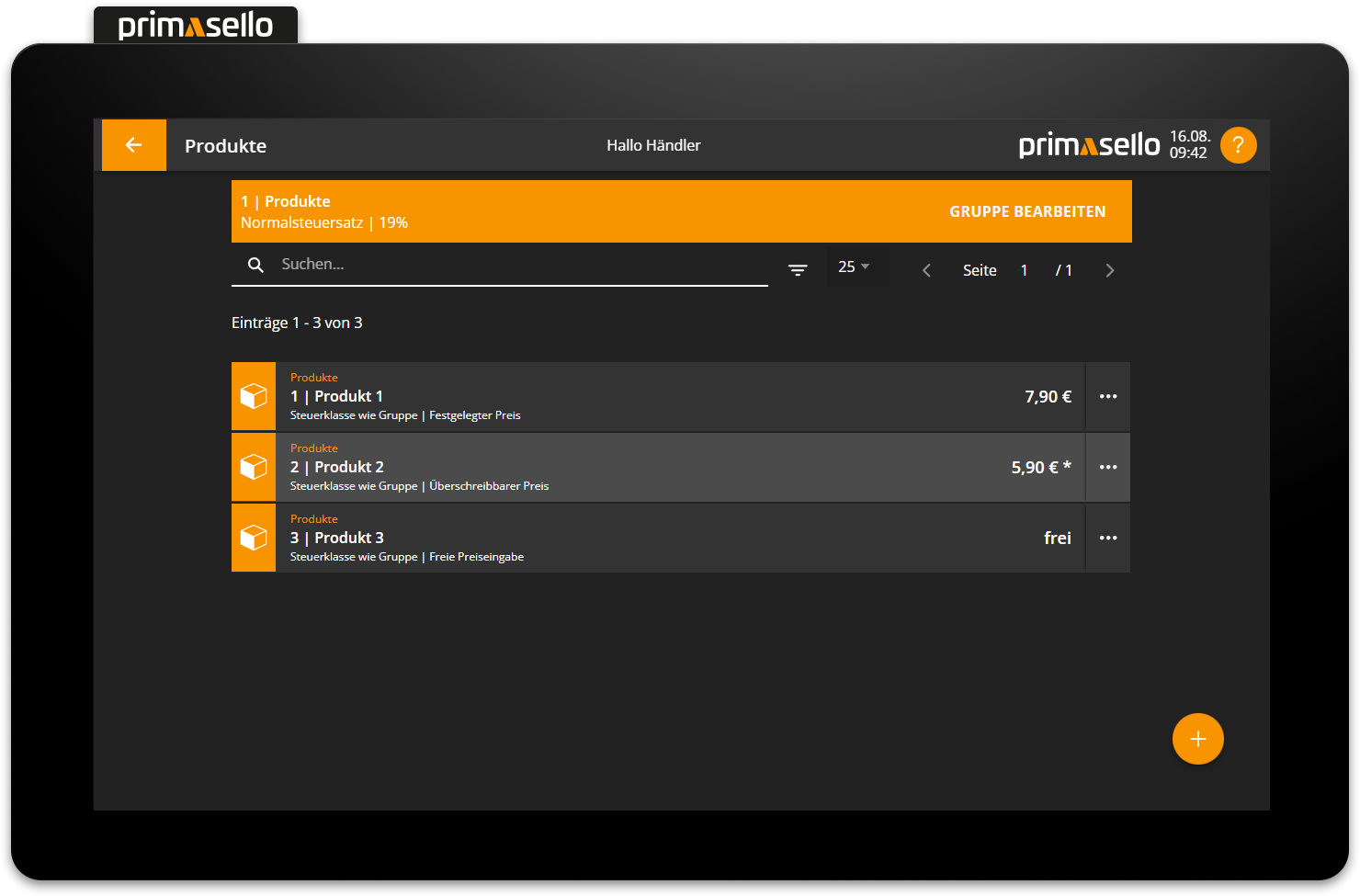

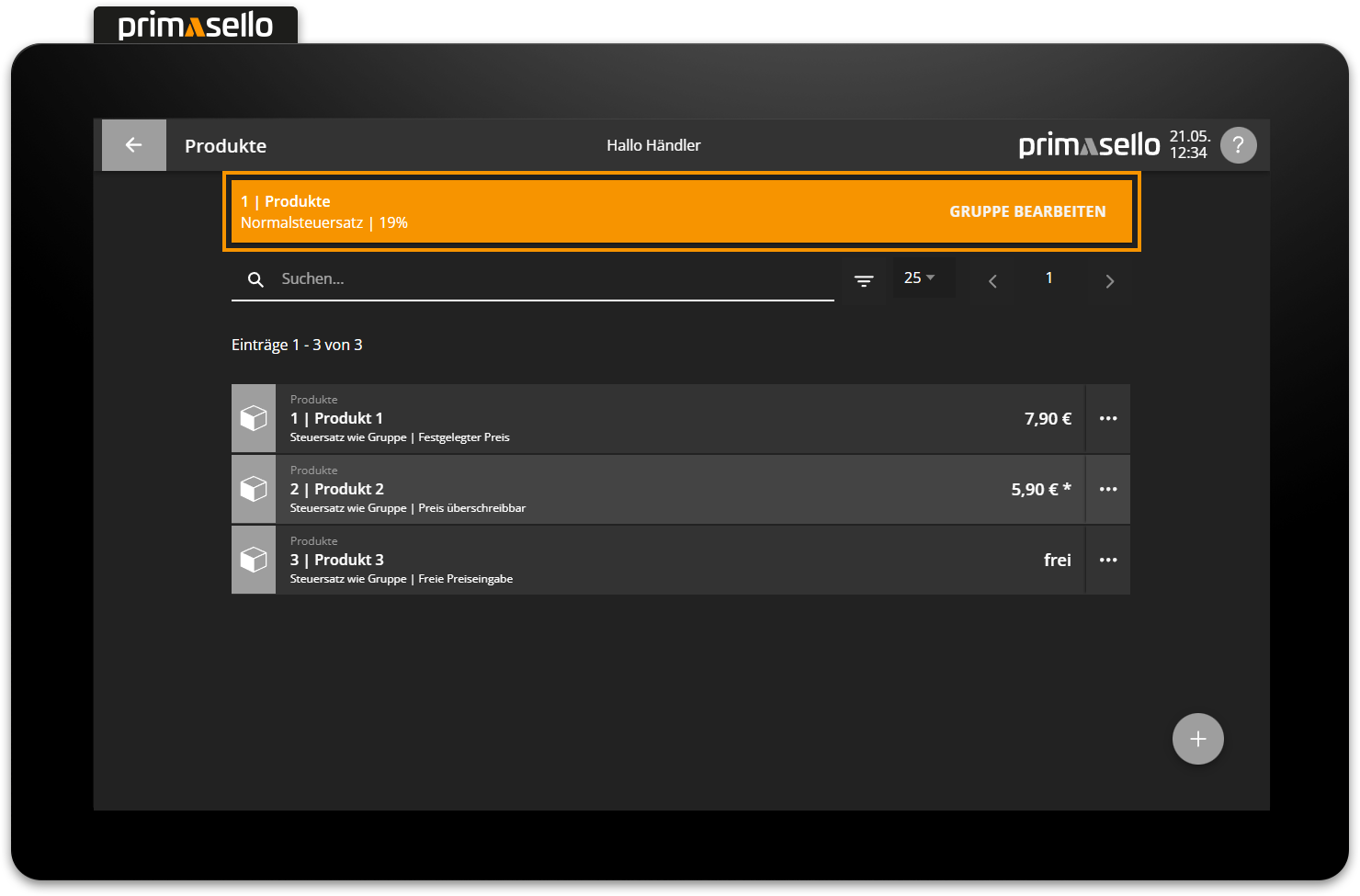

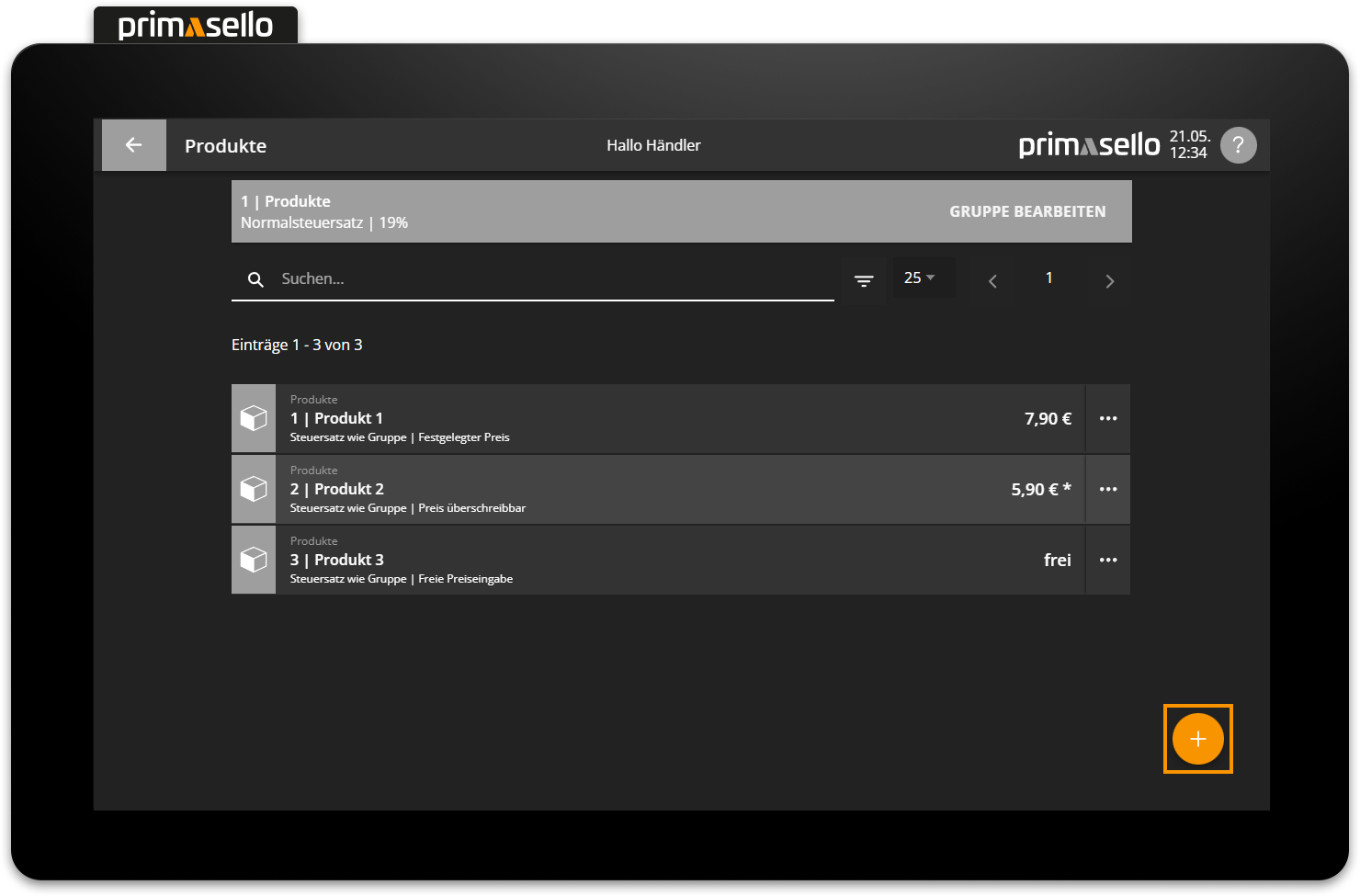

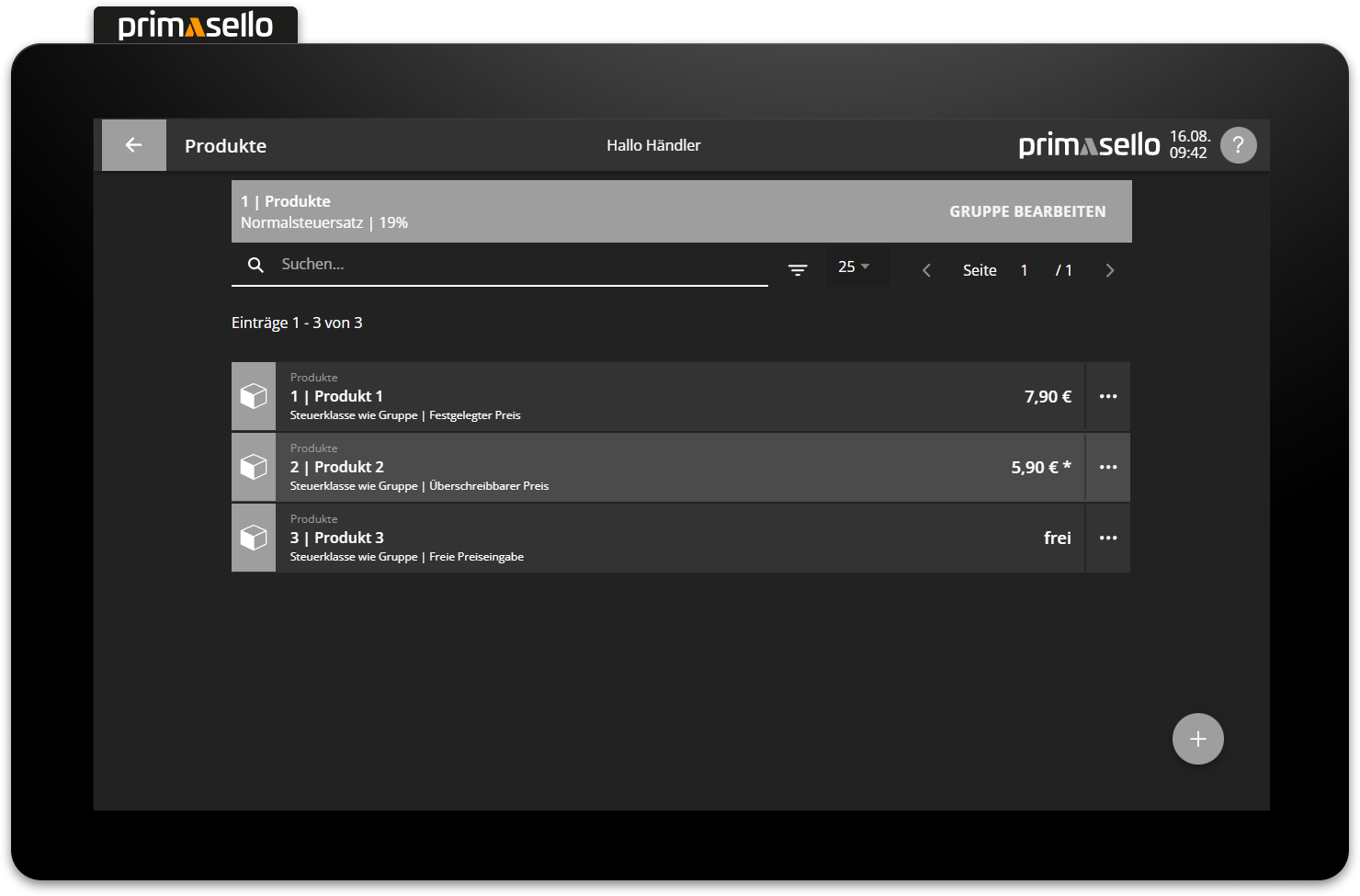

A list of all products in this product group is displayed.

At the top of the list, the selected group is displayed with the product group number and the default tax rate set for this group.

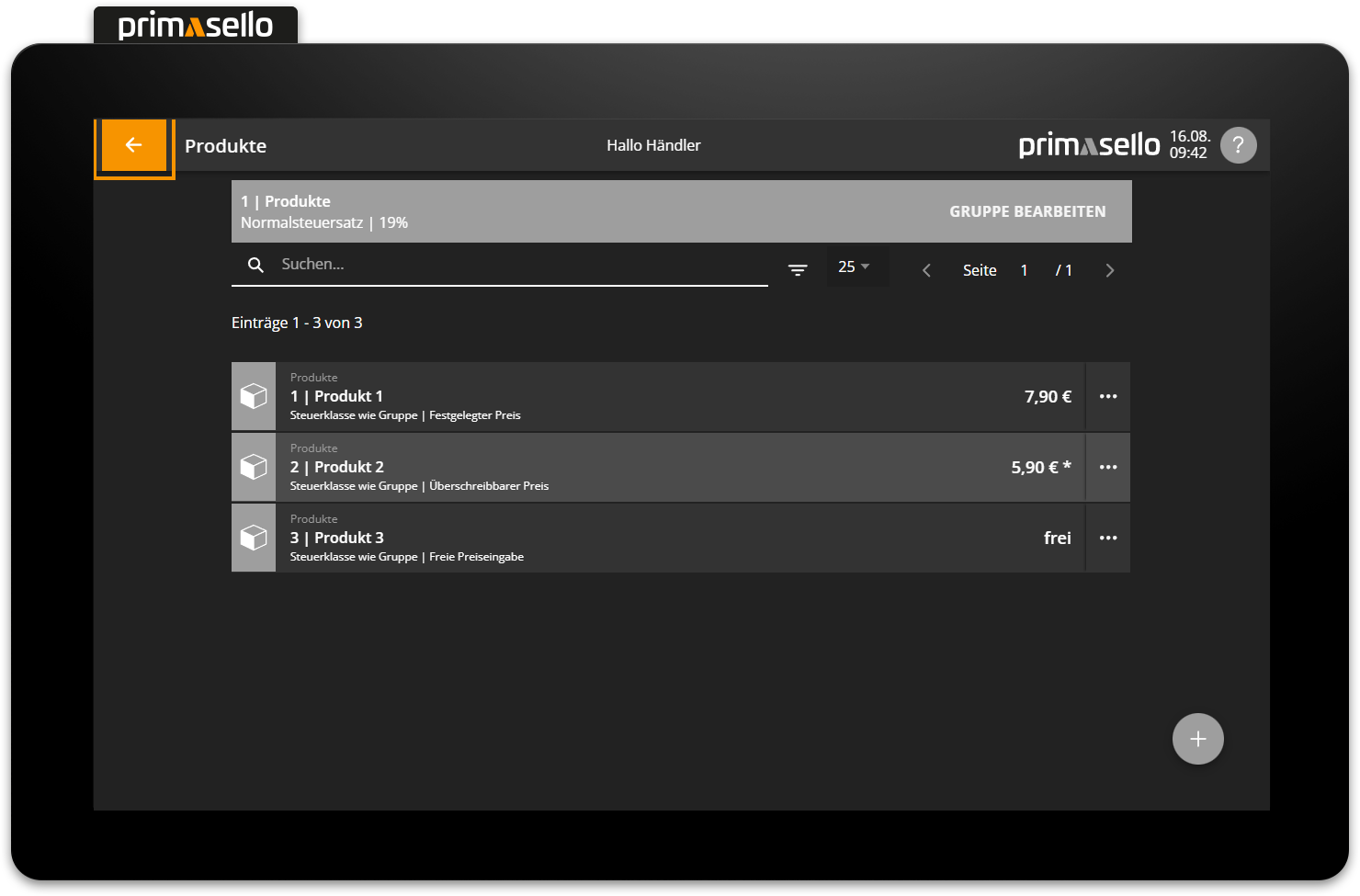

To return to the product group overview, press the ‘Back’ button on the left-hand side of the status bar.

Tip

The current product group can be edited by pressing the ‘Edit group’ button at the right end of the orange bar.

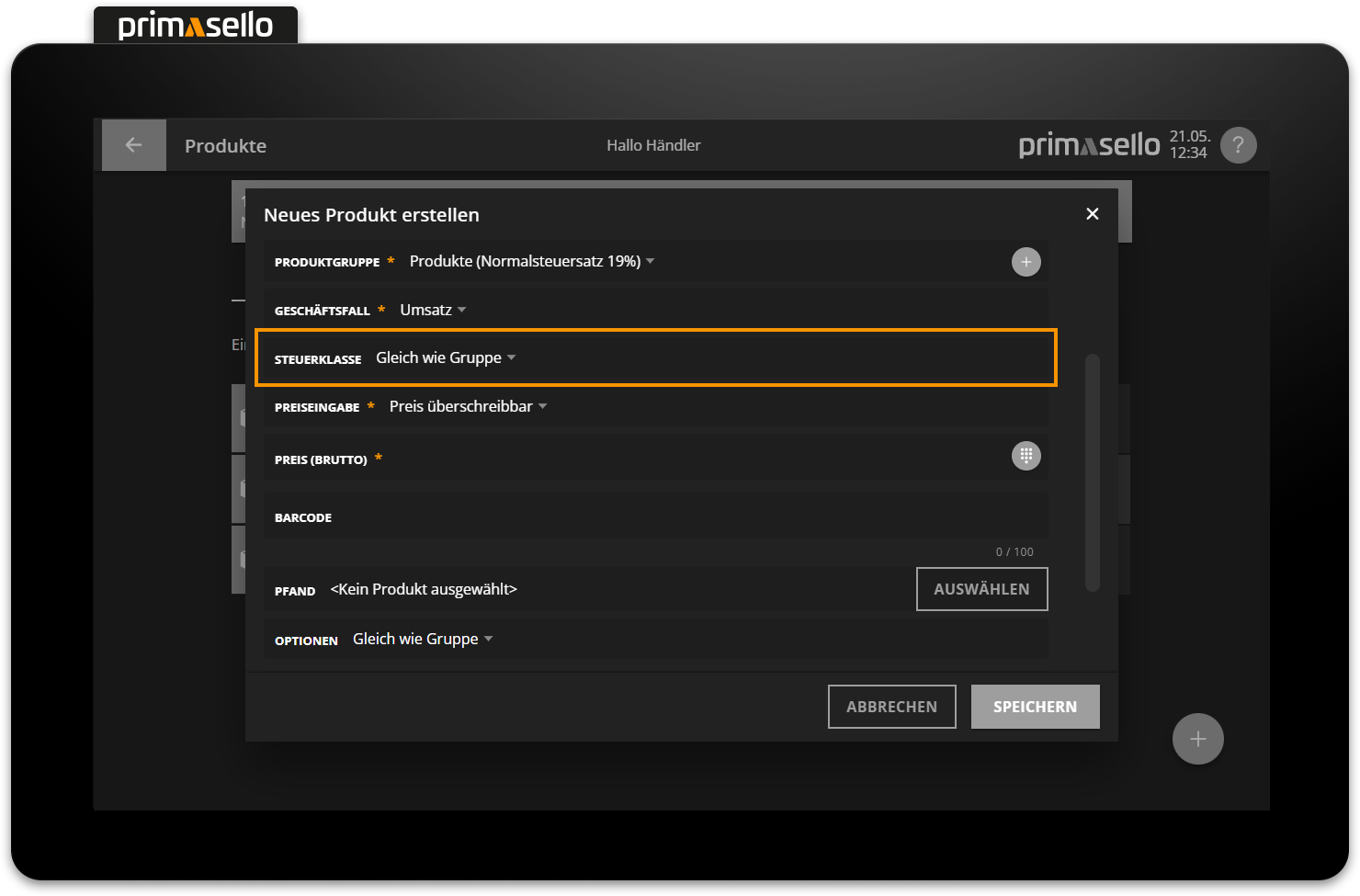

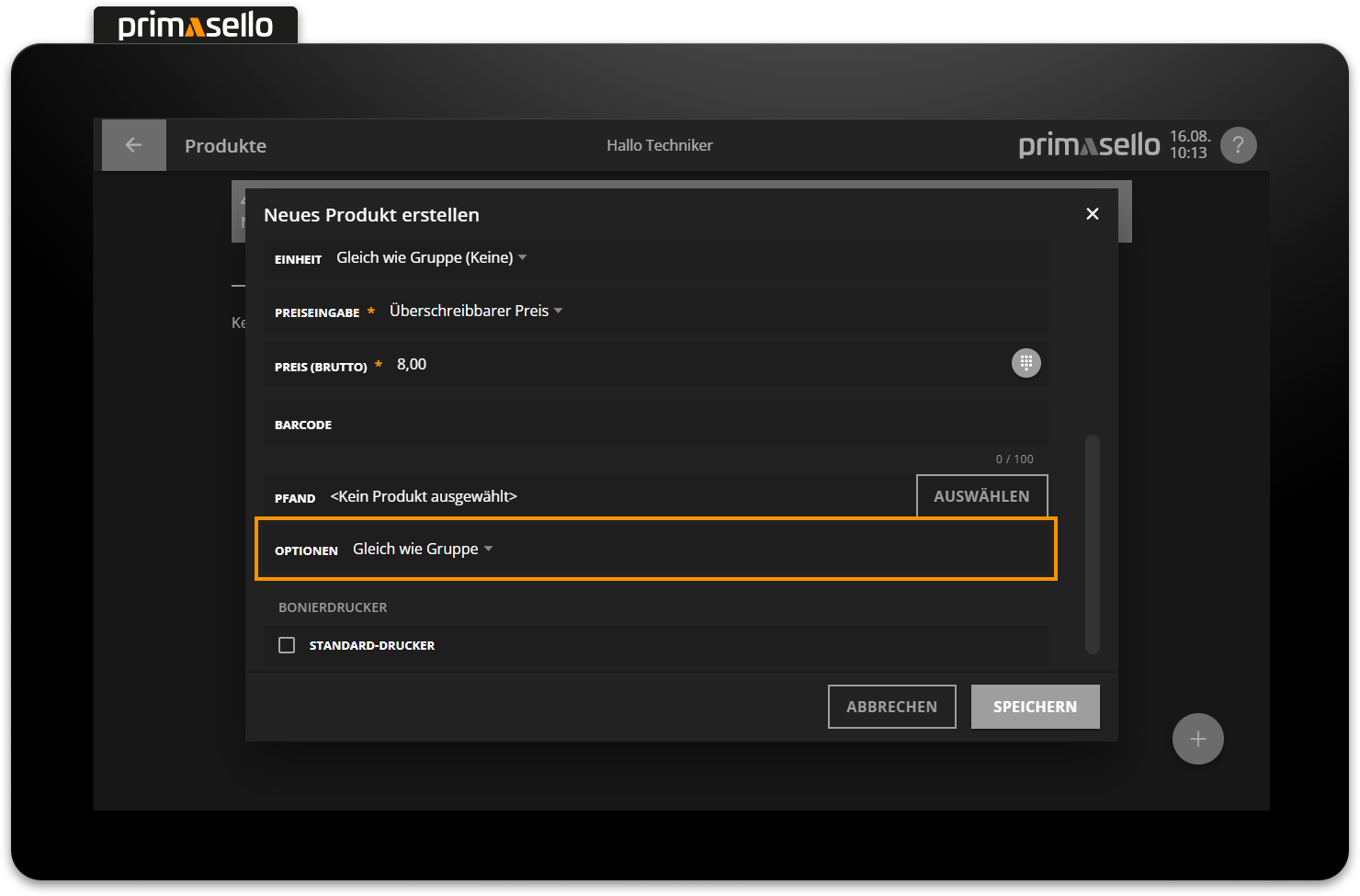

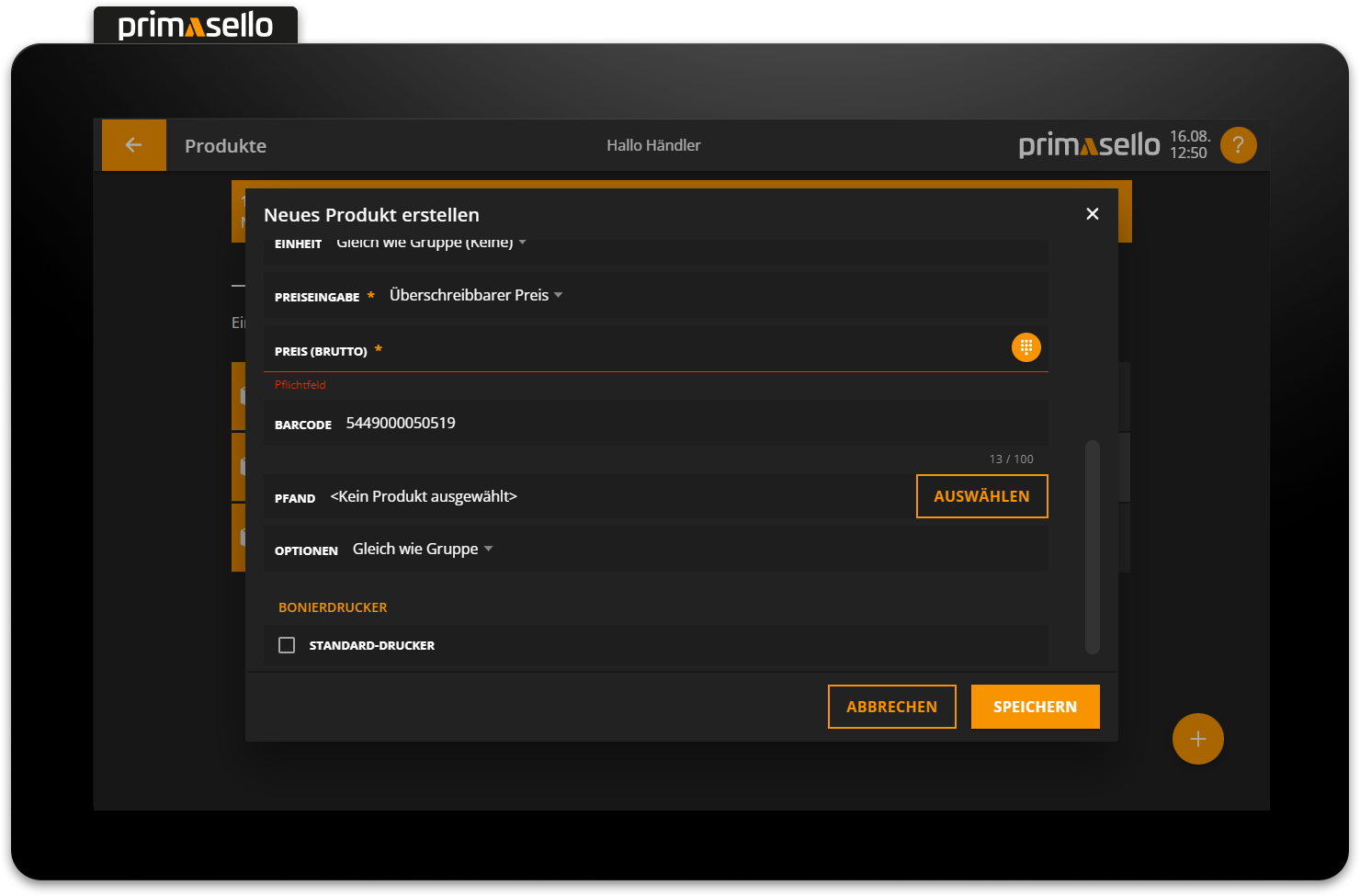

Create new product

To create a new product, press the orange ‘plus’ button at the bottom right of the screen.

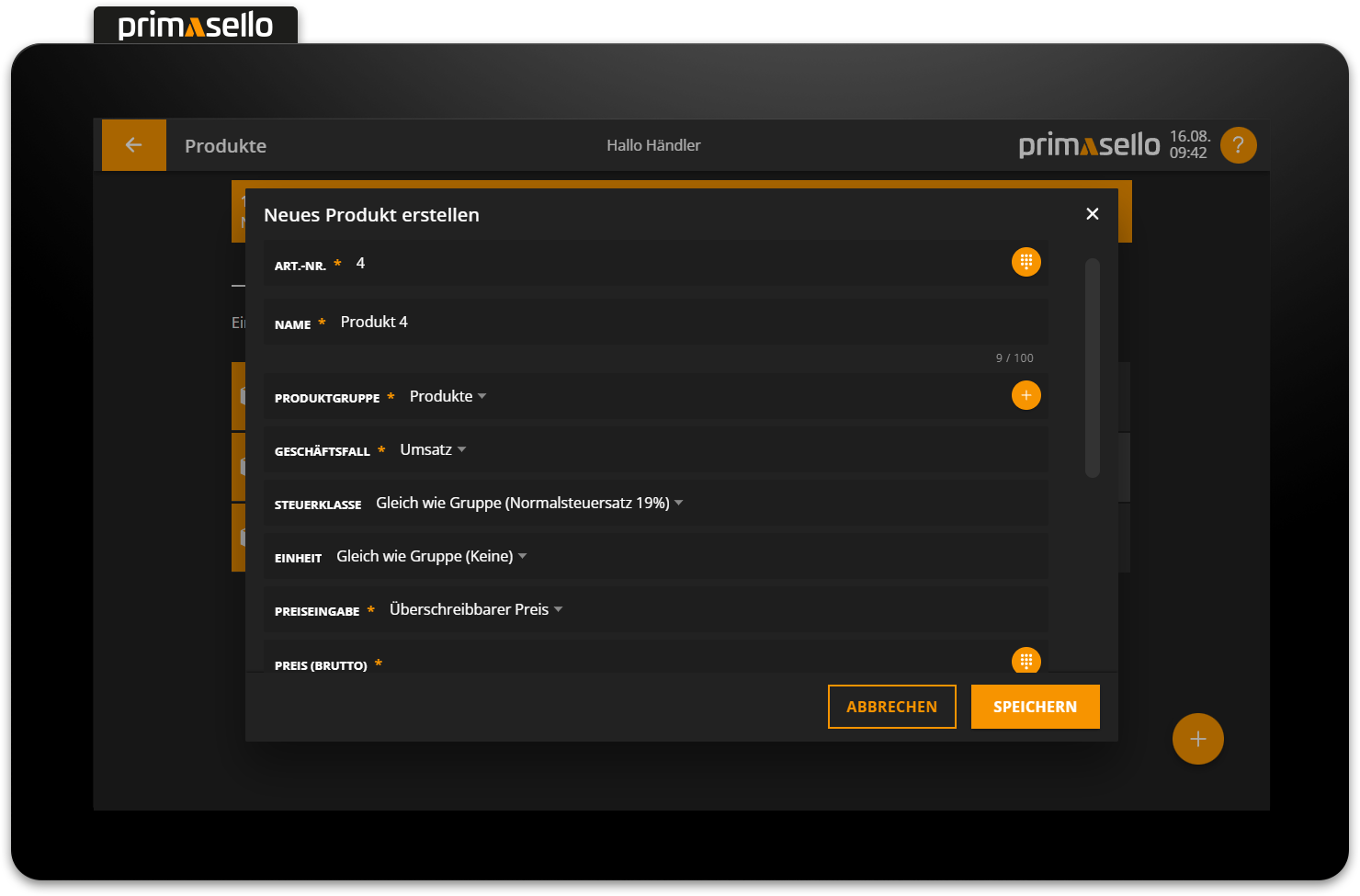

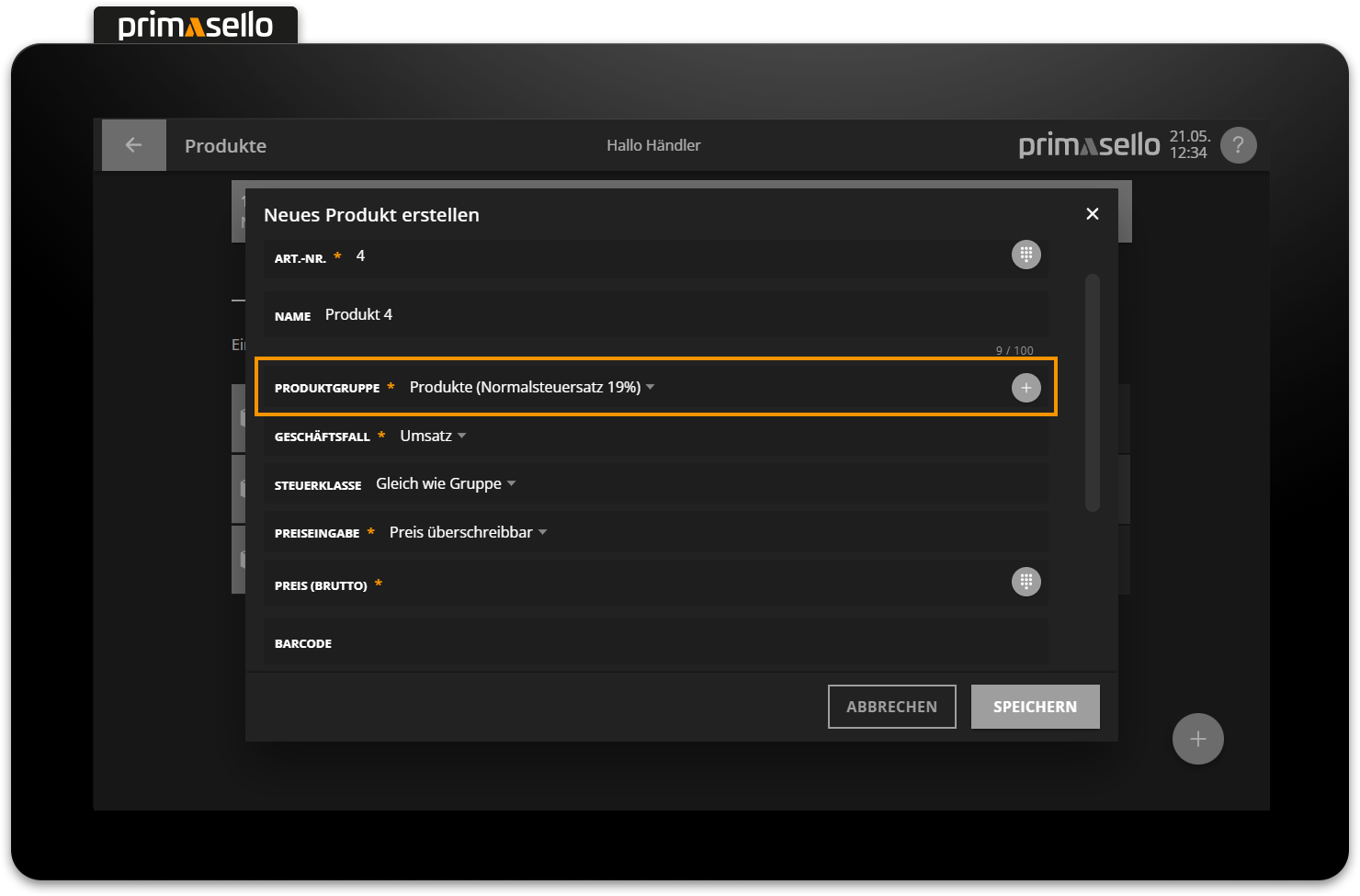

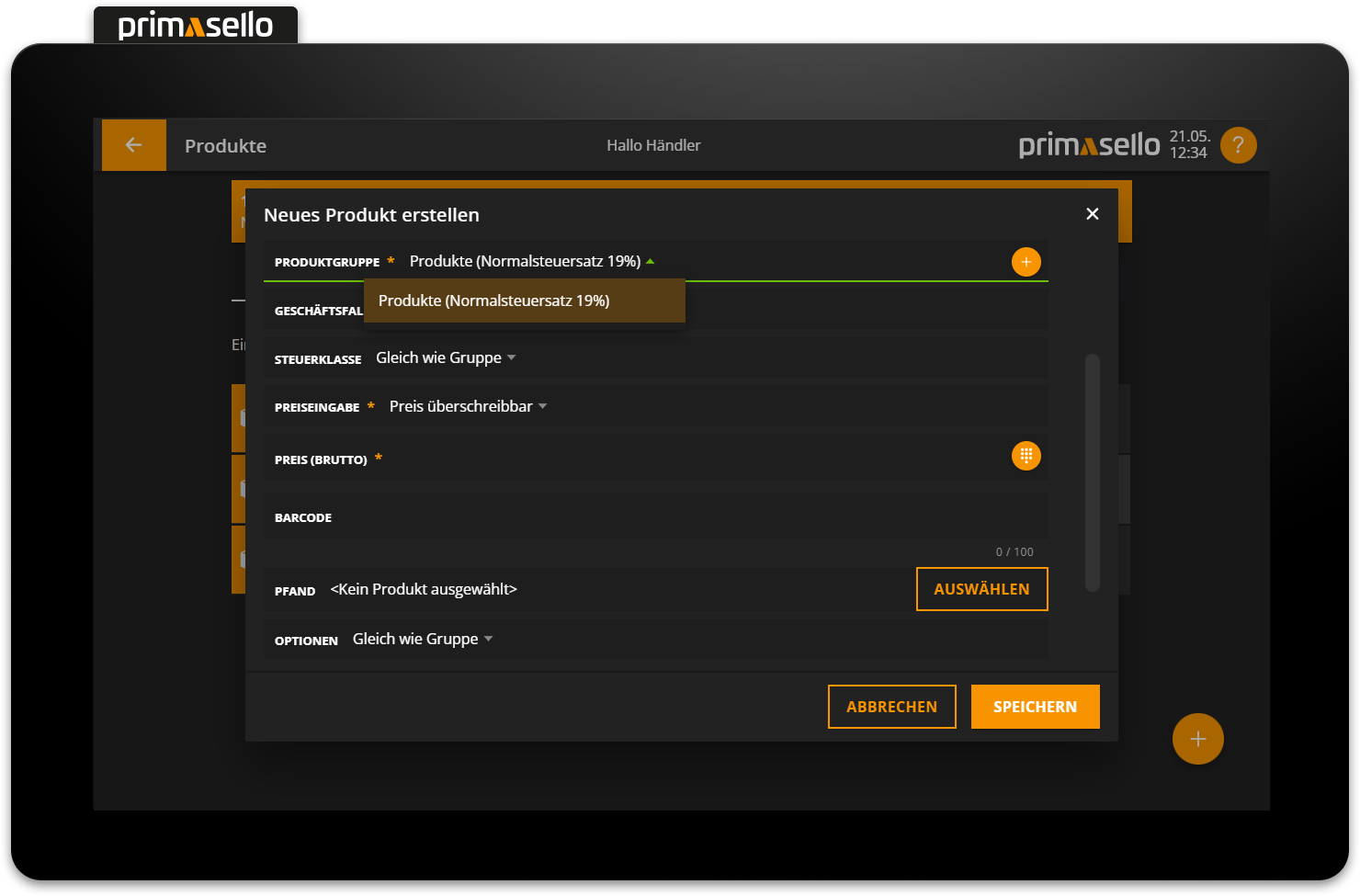

A separate window will open in which you must enter the information about the new product. Most fields are automatically pre-filled and can be edited by clicking on them.

The product is automatically assigned the next highest item number that has not yet been used.

The current product group is automatically pre-filled in the product group field, but you can also select a different product group from the selection.

A business case can be defined for each product. ‘Sales’ is selected here by default. Other business cases can be selected here for the sale/redemption of vouchers or the registering of pawn.

Business case

For the proper documentation of sales and returns, the appropriate business case must be stored with each product. The possible business cases are described below.

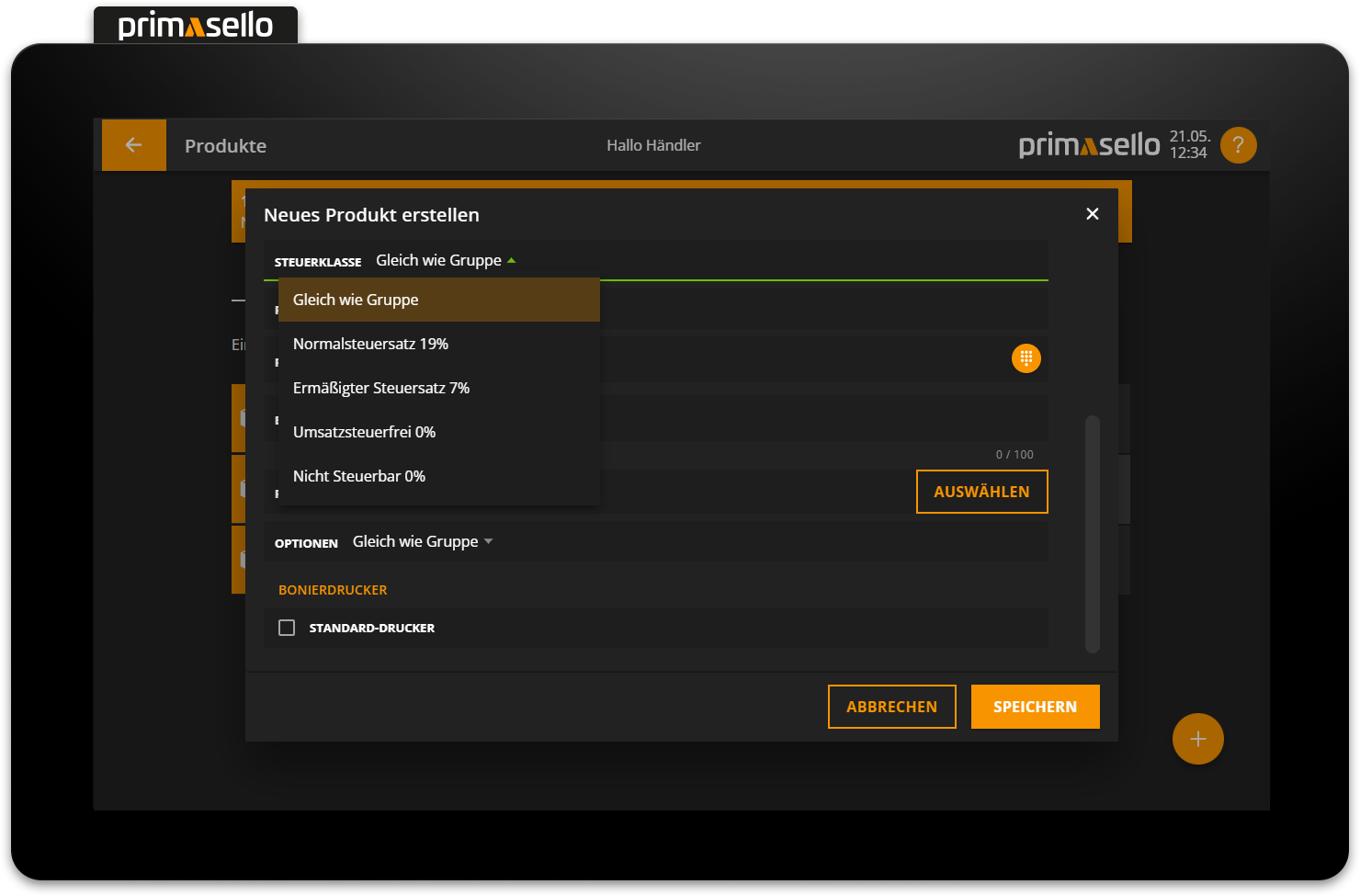

In the tax class field, the ‘Same as group’ option is selected by default, which means that the standard and alternative tax classes for the ‘Dine in / Takeaway’ function are adopted for the product group. Alternatively, other tax classes can be selected for the new product. The alternative tax class for the ‘Dine in / Takeaway’ function can only be changed if the standard tax rate is also changed and ‘Same as group’ is not selected.

"In house / Out of house" function

How to activate the ‘In House/Out of House’ function is explained in the chapter Dine in / Takeaway - Function.

How to switch between ‘In house’ and ‘Out of house’ when creating receipts is explained in the chapter Dine in / Takeaway.

Tax rates

Sorting products with the same VAT rate into a product group has the advantage that, in the event of a tax rate change, only the tax class of the product group needs to be changed. All products contained therein and selected as ‘Same as group’ in the tax class field will automatically be charged at the new VAT rate.

How to add new tax rates and edit existing ones is explained in the chapter Tax classes.

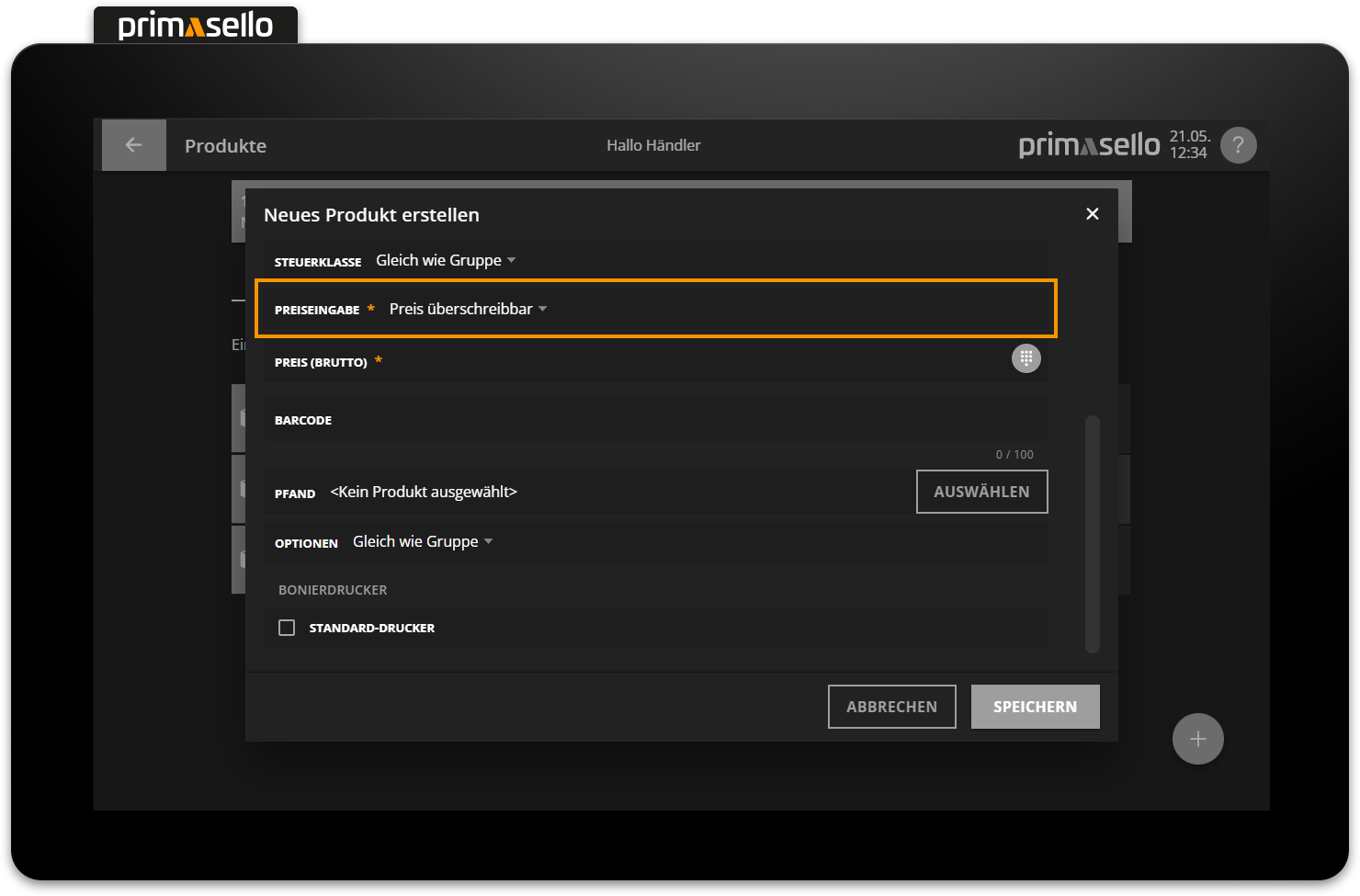

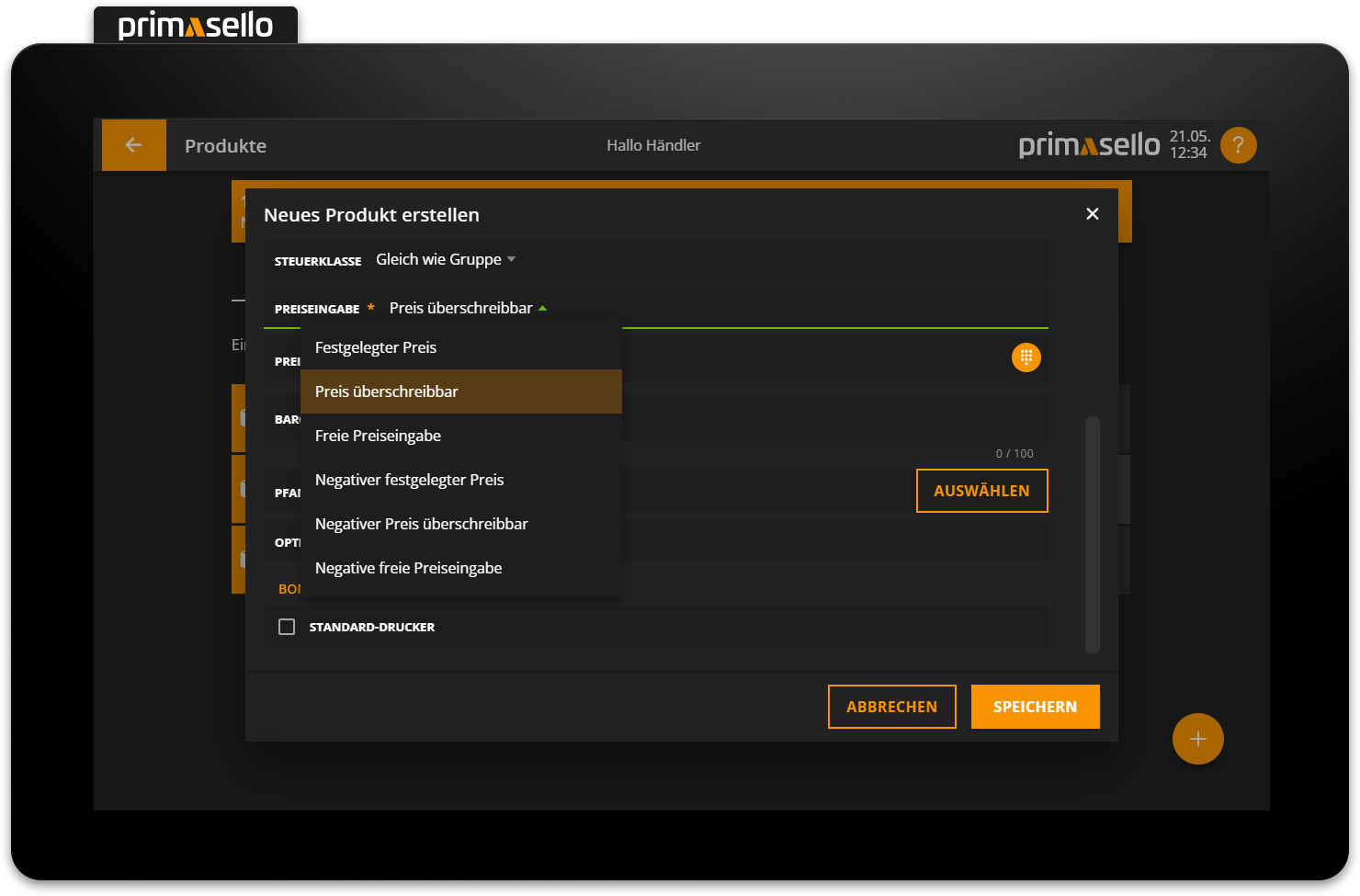

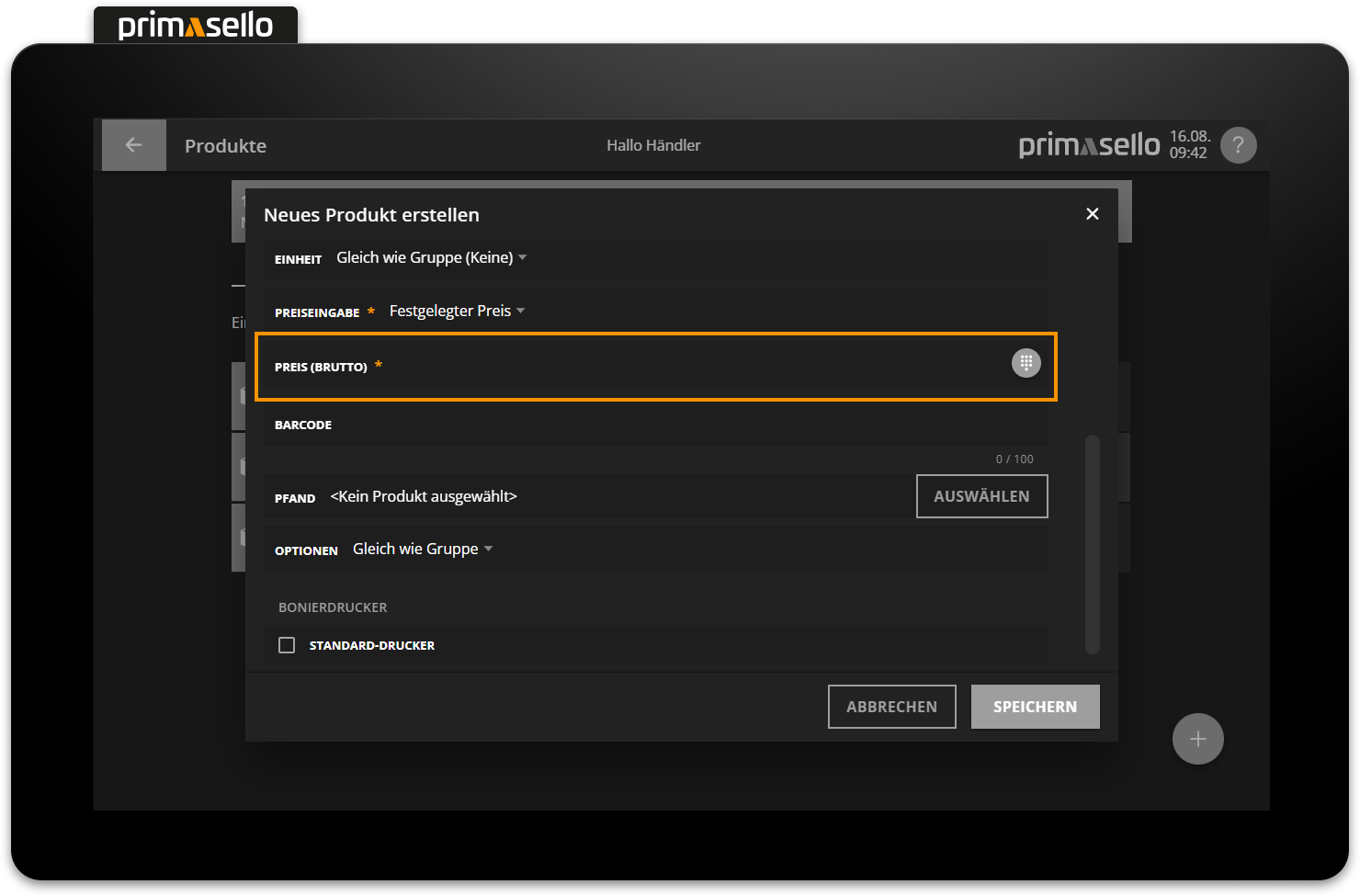

In the price input field, you must specify how the product price is entered. There are five options available; ‘Price can be overwritten’ is selected by default.

Depending on your selection, an additional field for entering the product price including VAT (gross price) will appear below the price input field.

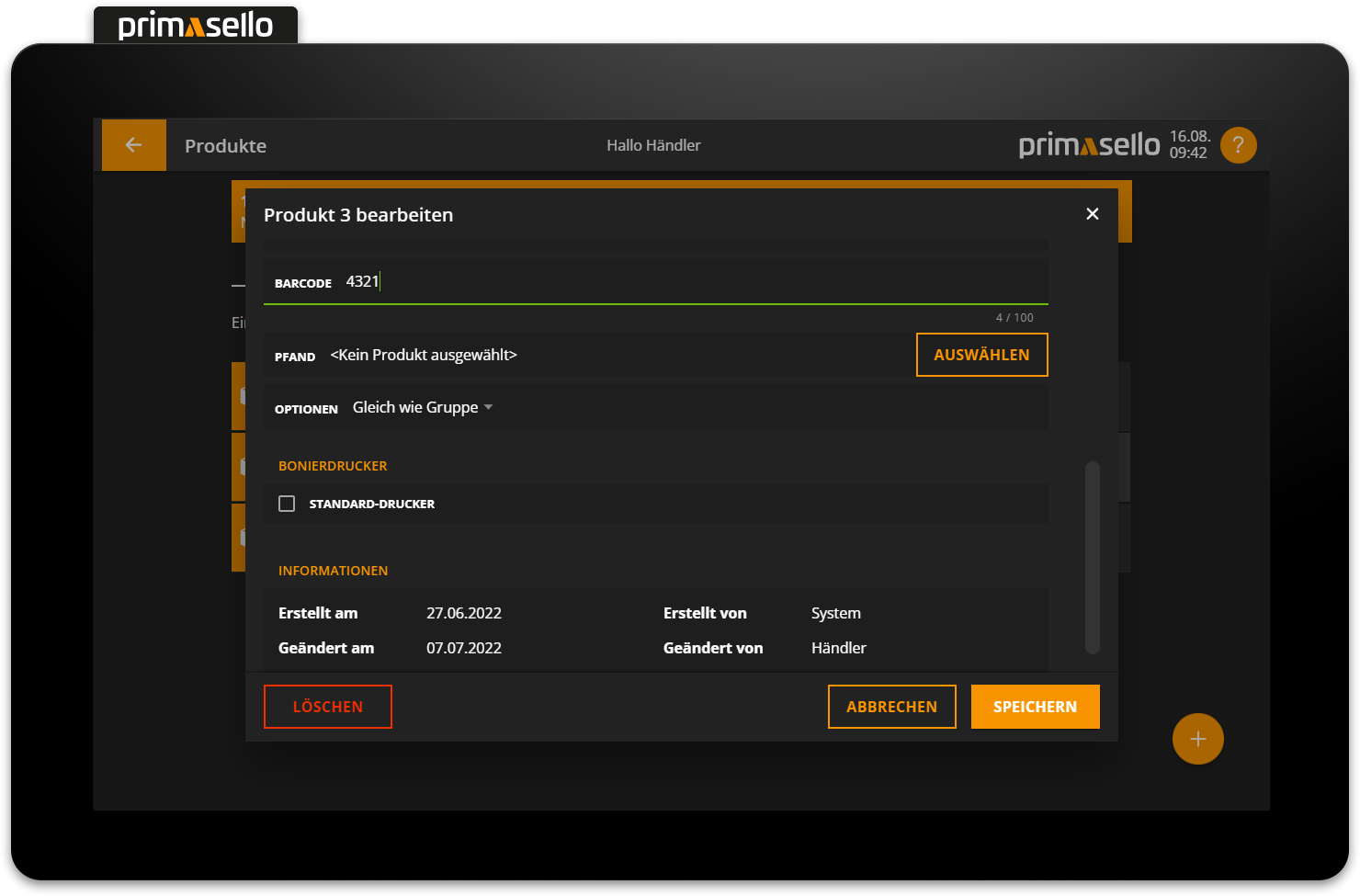

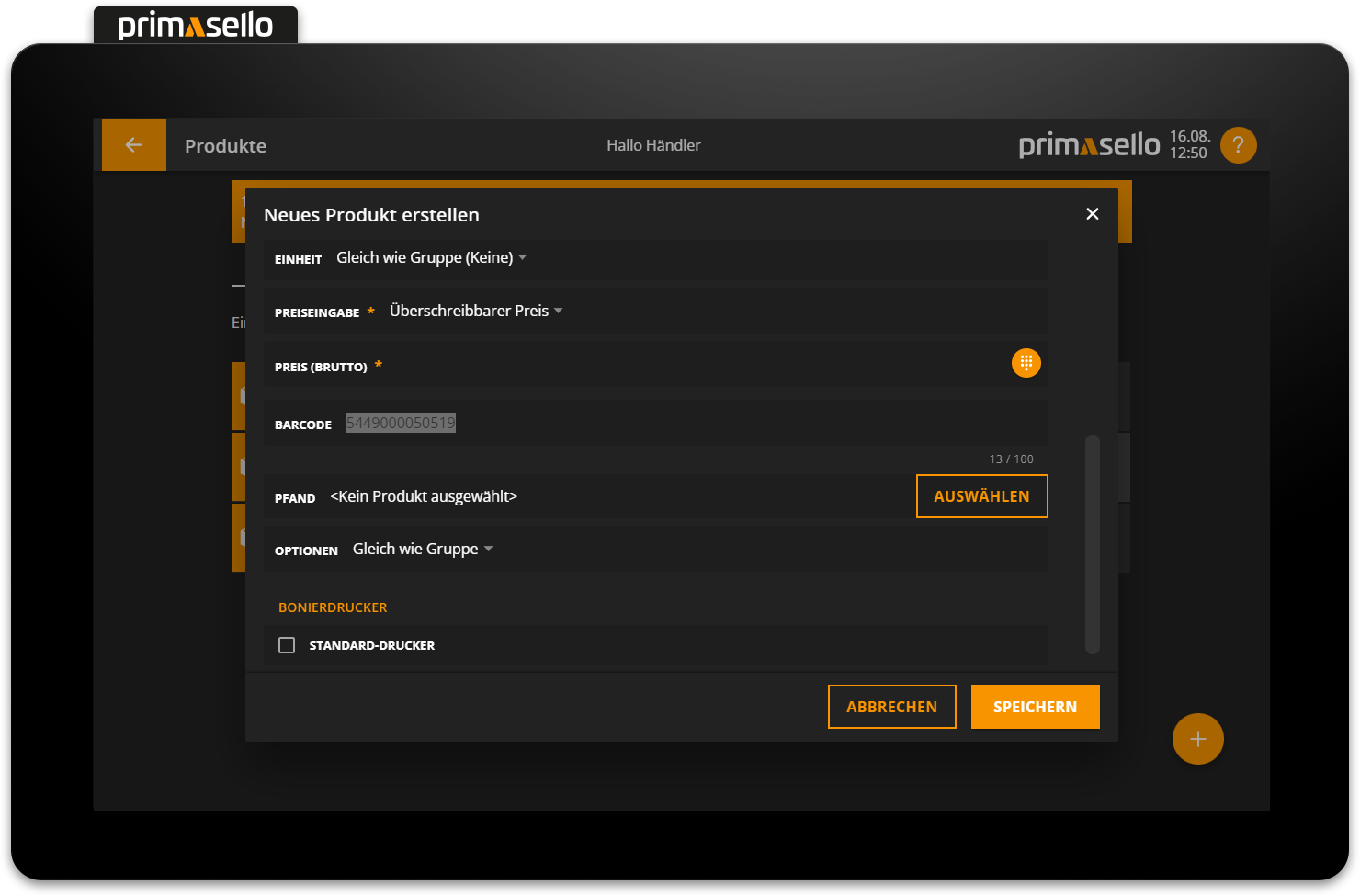

In addition, a barcode can be stored for a product. To make it easier to enter the barcode, it can simply be scanned while editing or creating a product. The field is automatically filled in with the scanned code.

Pressing the orange ‘Save’ button in the lower right corner creates the new product and closes the window. Creating a new product can be cancelled by pressing the “Cancel” button or by pressing the ‘x’ button in the upper right corner – all settings will be lost.

Edit product

To edit an existing product, press the relevant entry in the list. Alternatively, press the button with the three dots at the end of the line.

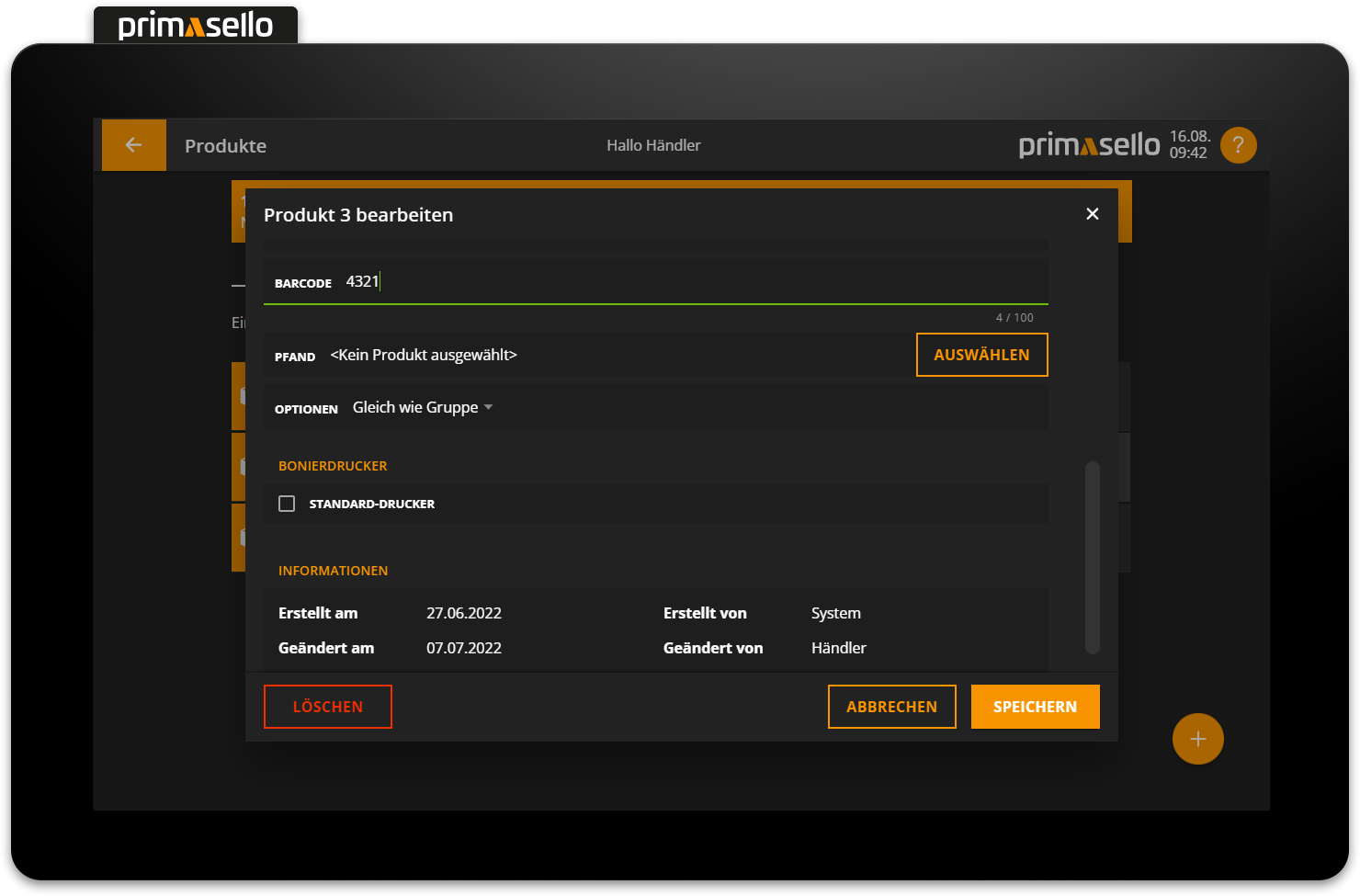

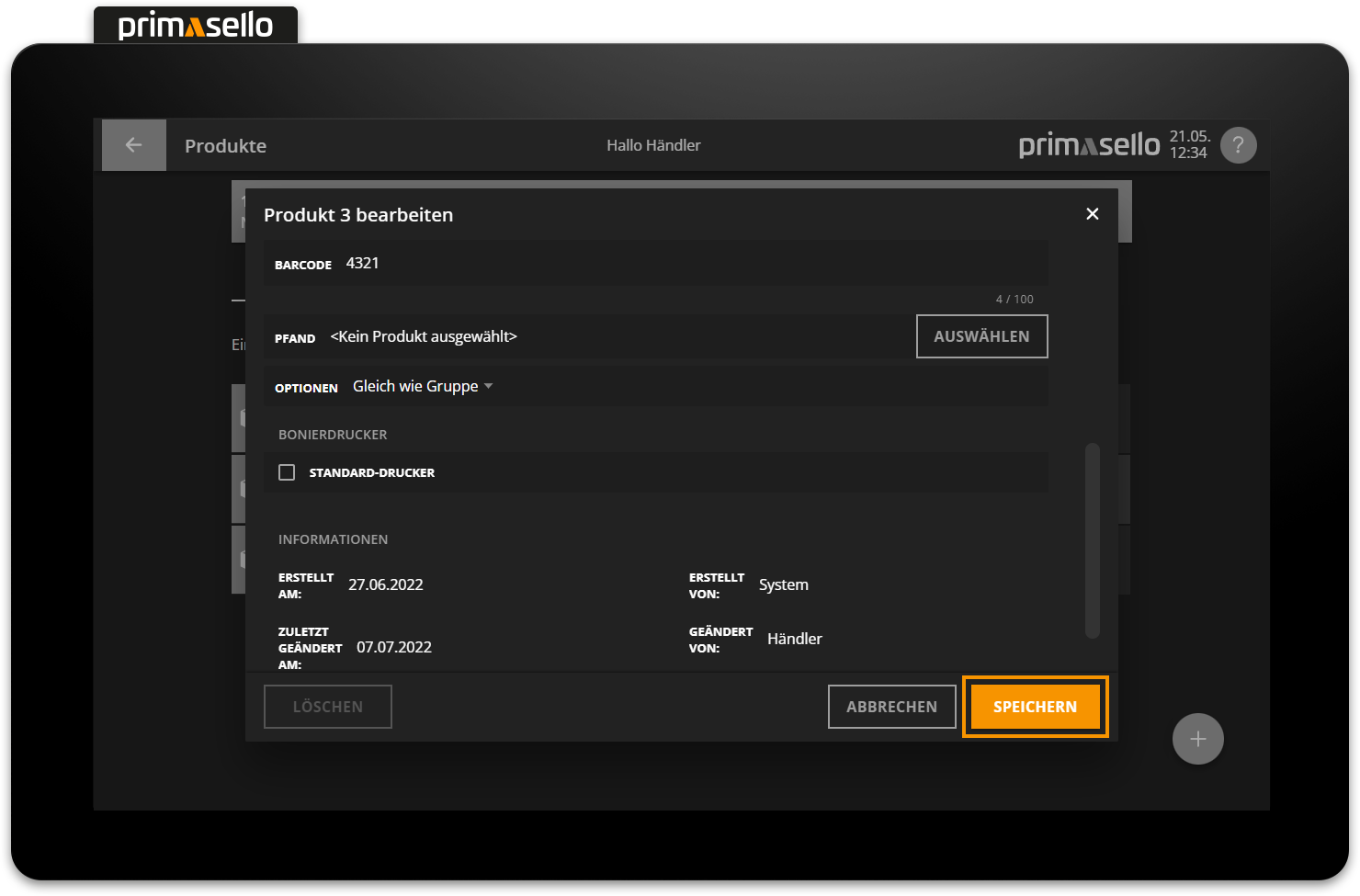

A separate window opens with information about the selected product. You can edit this by clicking on one of the fields.

Pressing the orange ‘Save’ button in the lower right corner applies the changes to the product and closes the window. Editing a product can be terminated by pressing the 'Cancel' button or by pressing the ‘x’ button in the upper right corner - all changes will be lost.

Options group

An options group can be assigned to each product. If the options group has been configured in the product group, the setting is automatically inherited by all products in this group. You can find the configuration options here Programming > Manage Products > Options.

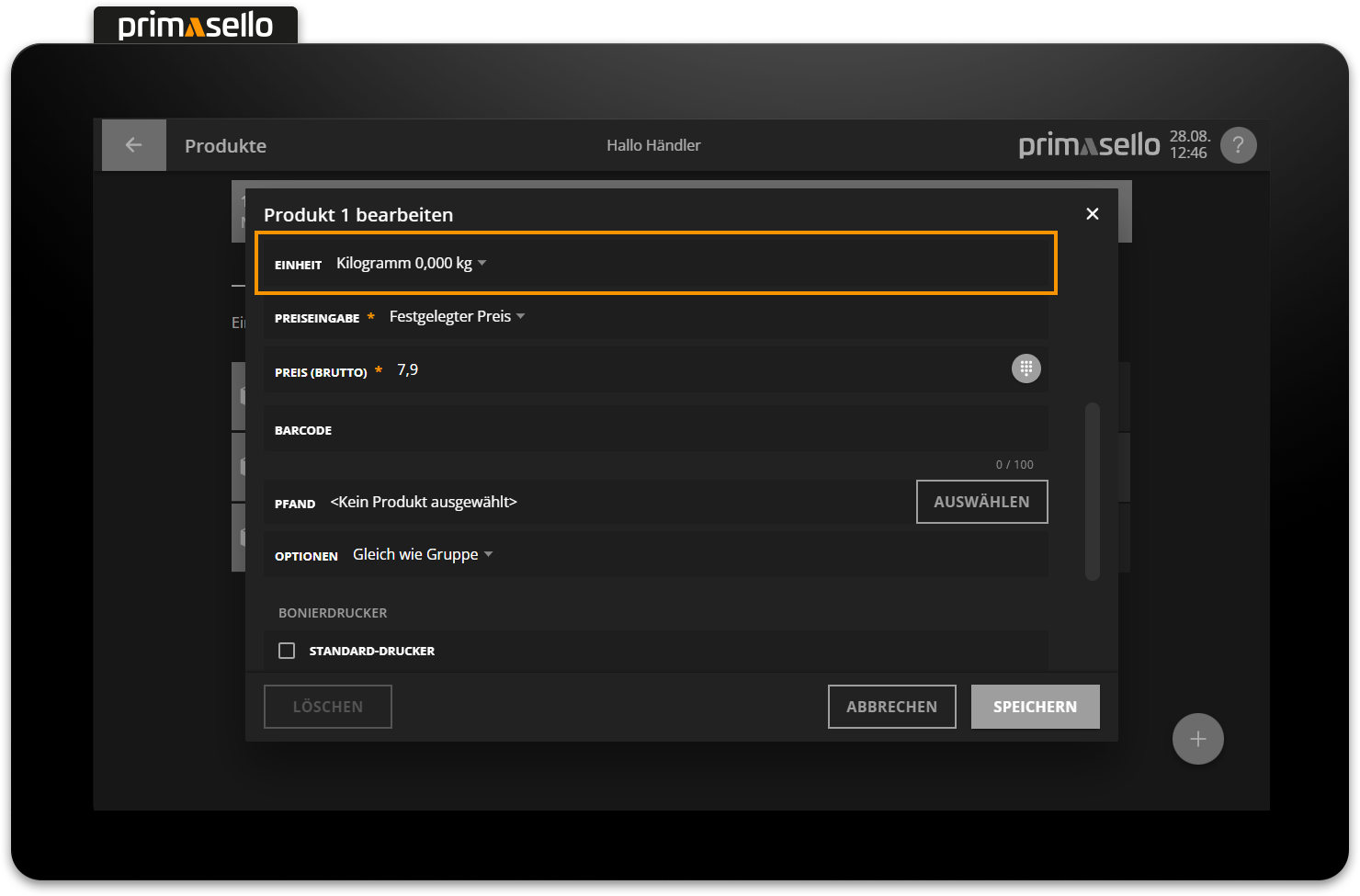

Unit

With the unit, the unit for all products in the product group can be controlled and inherited. The available units can be configured under Products > Units.

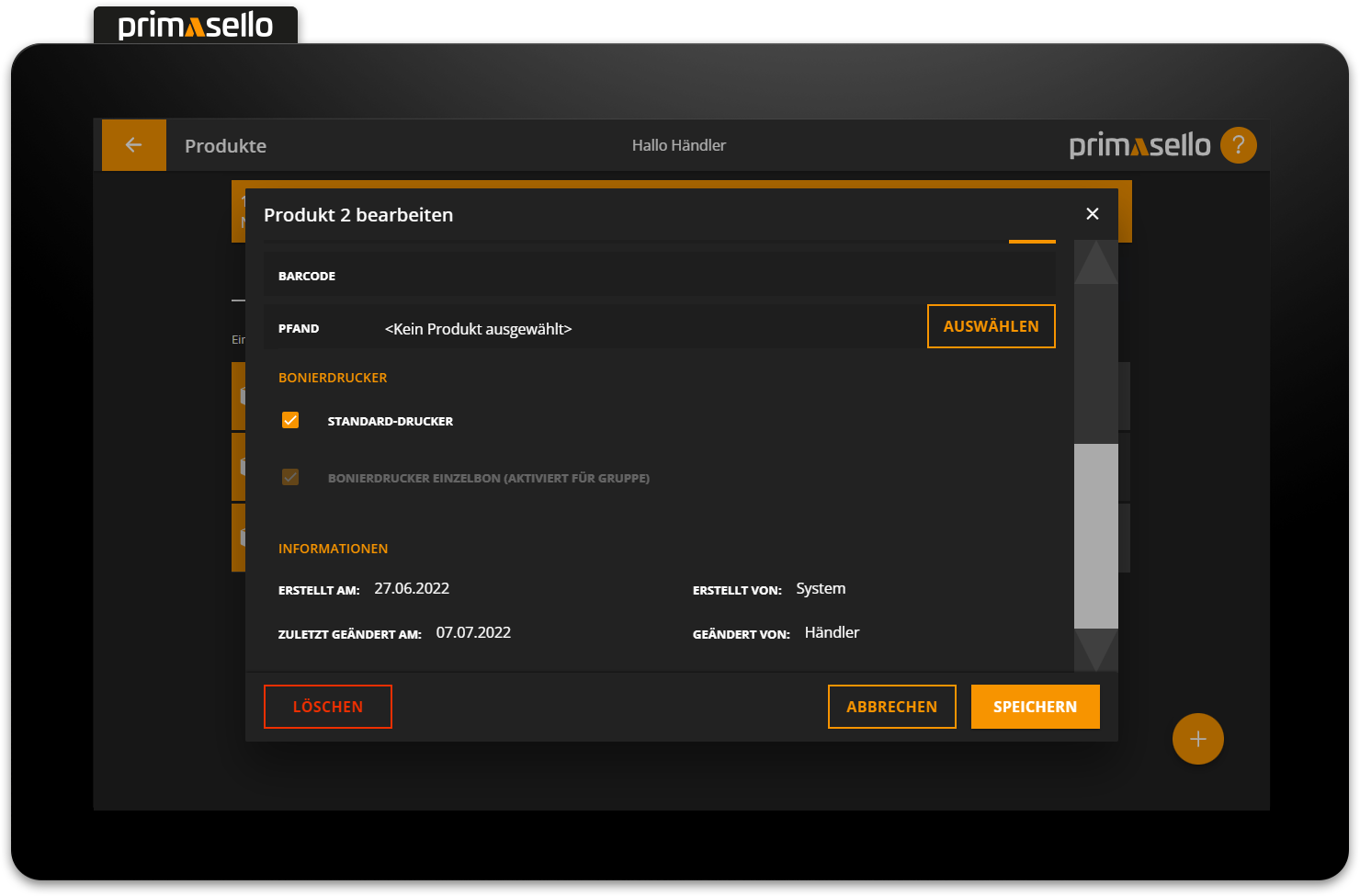

Receipt printer

If a receipt printer has been configured in the programming, it can be selected for a product under the heading ‘Receipt printer’. If a receipt printer is selected for a single product, a receipt will only be printed for that product.

If a receipt printer is activated for a product group, the same receipt printer cannot be selected for the products within the group.

Bons are printed after parking a shopping cart on a table or after creating an invoice.

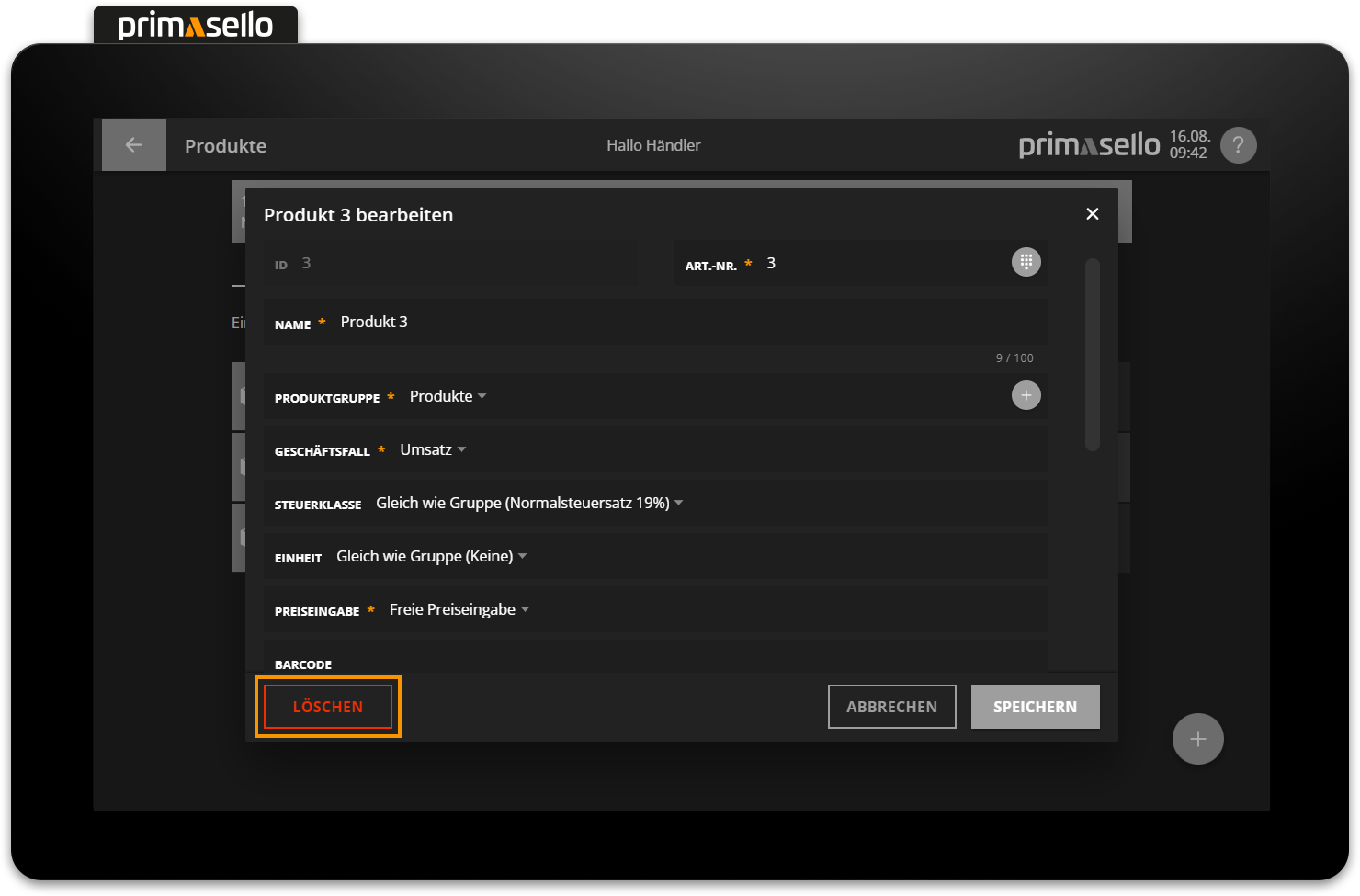

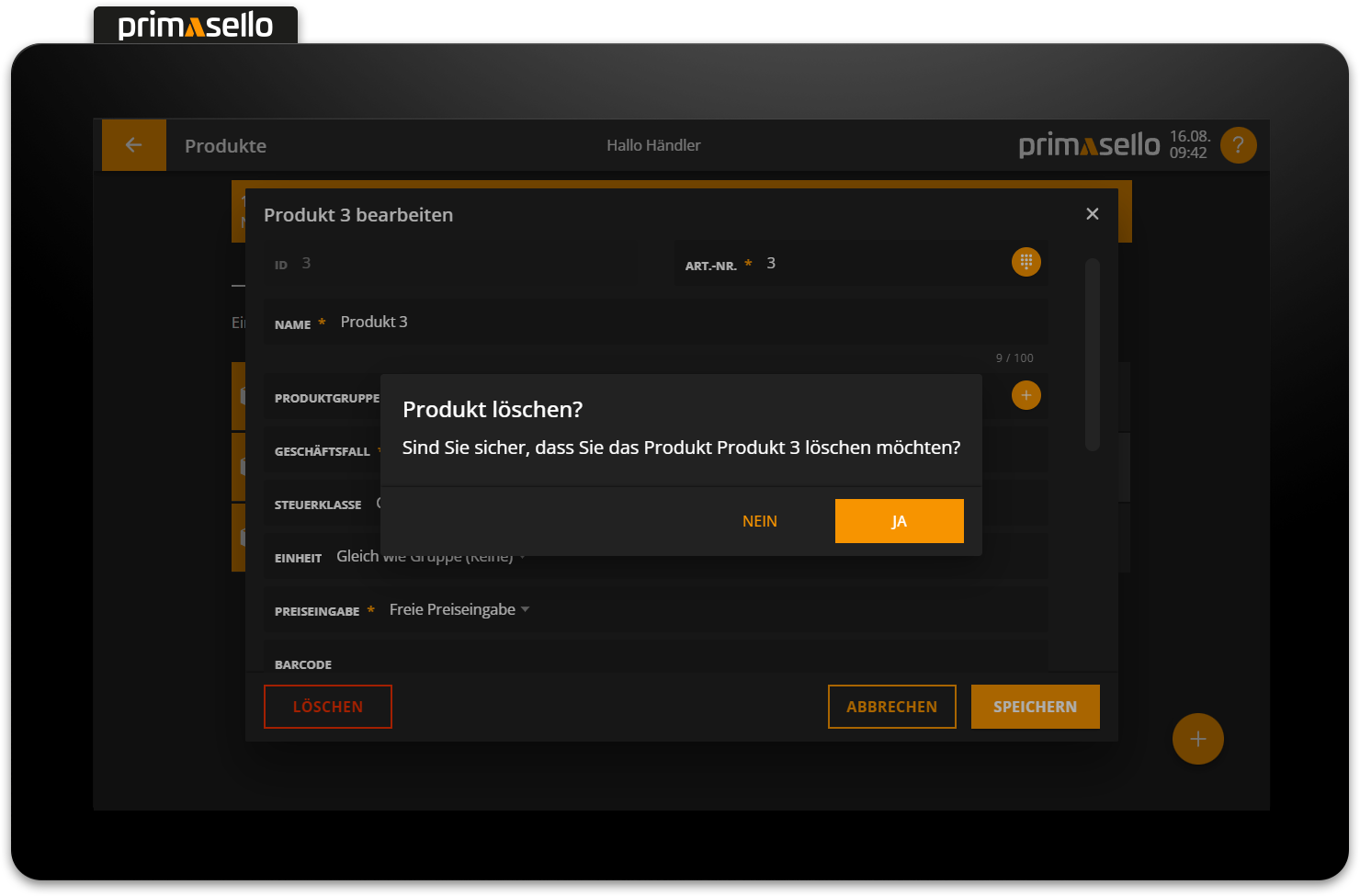

Delete product

To delete a product, select the relevant product from the list and click on the red ‘Delete’ button in the details window.

When this button is pressed, a security prompt appears, which must be confirmed with the ‘Yes’ button. The product is then deleted and the window closed. To cancel the deletion process, press the ‘No’ button.

Register interface

When a product is deleted, it does not automatically disappear from the register interface. The deleted product must be removed from the register interface, otherwise an error message will appear when registering the deleted product.

How products can be edited on the register interface is described in the chapter Programming.

Scan function

The barcode scanner makes it easy to open and edit existing products or create new ones.

If an existing product is scanned with the barcode scanner on the product group page or product page, it will open in a window and can be edited quickly.

Quick change

To quickly change prices when goods are received, individual products can be scanned one after the other and the price changed.

If a product is scanned that does not yet exist, a window opens for creating a new product in which the barcode is pre-filled and entered in the name field.

Unique name

When creating a new product using the scan function, a unique name is automatically assigned (product + barcode). This allows you to quickly create many new products.

Product types - Price input

Price input | Meaning | Example |

|---|---|---|

Fixed price | The price cannot be overwritten; the product must be registered without price input. | Product: Garden chair (€15.00) |

Overwriteable price | A fixed price can be stored for the product, which can be overwritten when registering by entering the price input beforehand using the numeric keyboard. | Product: Remaining stock Games (9,99 €*) Product has a fixed price that can be changed. |

Free price input | Before registering the product, a price must be entered using the numeric keyboard. | Product: voucher (free) Price may vary depending on voucher value. |

Negative fixed price | The price cannot be overwritten, the product must be registered without price input. The stored price is automatically calculated as negative when registering. Please note: The price must be entered as a positive amount and will be calculated negatively by the primasello register! | Product: Glass bottle return (-0,22 €) The product is always offset against the same negative amount. |

Negative overwriteable price | The fixed price entered for the product is automatically calculated as negative. When registering, the price can be overwritten by entering the price input beforehand using the numeric keyboard. Please note: The price must be entered as a positive amount and will be calculated negatively by the primasello register! | Product: Pawn return (-0,15 €*) Pawns are usually refunded at the same value (minus amount). |

Negative free price input | Before registeringing the product, a price must be entered using the numeric keyboard. The amount is automatically calculated as negative. Please note: The price must be entered as a positive amount and will be calculated negatively by the primasello register! | Product: Vouvher redeem (-free) Value (minus amount) may vary depending on the value of the voucher. |

Business cases

For the proper documentation of sales and returns, the appropriate business case must be stored for each product.

Business case | Meaning | Example |

|---|---|---|

Down payment | If a down payment is charged for a product and the product is delivered at a later date, the 'Down Payment' business case is used. Down payment products must be charged at the same tax rate as the product itself. | Product: Down payment (free) Down payment for a later delivery is recognised. |

Deposit resolution | The business case ‘Deposit resolution’ is used to reverse a down payment that has already been posted. Deposit resolution products must be offset against the same tax class as the product itself. | Product: Deposit resolution (-free) Deposit resolution will be cancelled upon delivery. |

Claim resolution | The business case ‘Claim resolution’ is used for the reversal of a claim that has already been posted. Claim resolution products must be offset against the same tax class as the product itself. | Product: Musicbox rental / day (- 50,00 €) Claim resolution will occur upon delivery. |

Claim arises | If a claim is made for a product and the product was delivered at an earlier point in time, the 'claim arises' business case is used. Claim arises products must be offset against the same tax class as the product itself. | Product: Musicbox rental / day (50,00 €) The claim will be posted after delivery. |

Redeem single-purpose voucher | The business case ‘Redeem single-purpose voucher’ is used to redeem, i.e. devalue, a previously sold single-purpose voucher. Redeem single-purpose voucher products are exempt from VAT. | Product: Redeem voucher for updo hairstyle (-75,00 €*) Voucher for a specific product is redeemed. |

Voucher sale single-purpose | If vouchers are charged for which it is already clear at the time of sale which product they can be redeemed for (e.g. free product), the business case 'Voucher sale single-purpose' is used. Voucher sale single-purpose products must be charged at the same tax rate as the product itself. | Product: Voucher for updo hairstyle (75,00 €) Voucher for a specific product is being sold. |

Redeem multi-purpose voucher | When multi-purpose vouchers are redeemed, the business case ‘Redeem multi-purpose voucher’ is used. Voucher multi-purpose sales products are not taxable. | Product: Redeem voucher (-free) Voucher will be redeemed. |

Voucher sale multi-purpose | All voucher sales where the product has not yet been determined at the time of sale (e.g. value vouchers) are documented as a 'voucher sale multi-purpose' business case. Voucher sale multi-purpose products are not taxable. | Product: Voucher 10 (10,00 €) Voucher for € 10.00 is sold. |

Pawn | The pawn business case is used for the settlement of pawn products. Pawn products must be charged with the same tax class as the main service (product/service to which the pawn belongs). | Product: Pawn glas bottle (0,25 €) Pawn in addition to product. |

Pawn return | When a container on which a pawn has been charged is returned and/or a withdrawal of pawn to the customer occurs, the “pawn return” business case is used. Pawn return products must be offset against the same tax class as the main service (product/service to which the pawn belongs). | Product: Pawn return glas bottle (-0,25 €*) Pawn container is returned. |

Tip | When posting tips that are given to employees, the 'tip' business case is used. For the withdrawal of tips, the same business case is used. Tip products are exempt from VAT. | Product: Tip (free) Product: Tip withdrawal (-free) Tips are booked or paid out in the register. |

Tip company | If tips are recorded in the register and handed over to the employer, the business case 'tip company' is used. A private withdrawal or cash transit must be made for the skimming of the tip (Cash withdrawal). | Product: tip company (free) Tips are paid to the company and recorded in the register. |

Turnover | All products available for normal sale are documented as 'turnover' business case. Turnover products can be offset against all tax classes. | Product: Portion of fries (4,50 €) Product is sold regularly. |

Subsidy real | The business case ‘subsidy real’ is used for all payments that are not made by the recipient of the product or service, but by a paying third party. The paying third party may not receive any service in return for their payment. (If there is an exchange of services, the business case ‘subsidy unreal’ must be used). Subsidy real products are not taxable. | Product: Meal subsidy (-2,00 €) Subsidy is offset against employer, benefit is paid to employee. |

Subsidy unreal | The business case ‘subsidy unreal’ is used for payments from third parties that cannot be defined as ‘subsidy real’. There is an exchange of services between the paying third party and the payment recipient. Subsidy unreal products must be offset against the same tax class as the product or service. |

Error messages

The following error messages may occur. The error messages are always displayed next to the affected input field. The field and the message are highlighted in red.

Error message | Meaning | Solution |

|---|---|---|

This number already exists. | The product group number or item number of the product is already stored for another product. | Check the number and assign another number. |

Maximum input exceeded. | The input may only have a certain character length. The maximum length is displayed at the end of the line (e.g. 13 / 100). | Shorten the input to the maximum value. |