Tax Classes

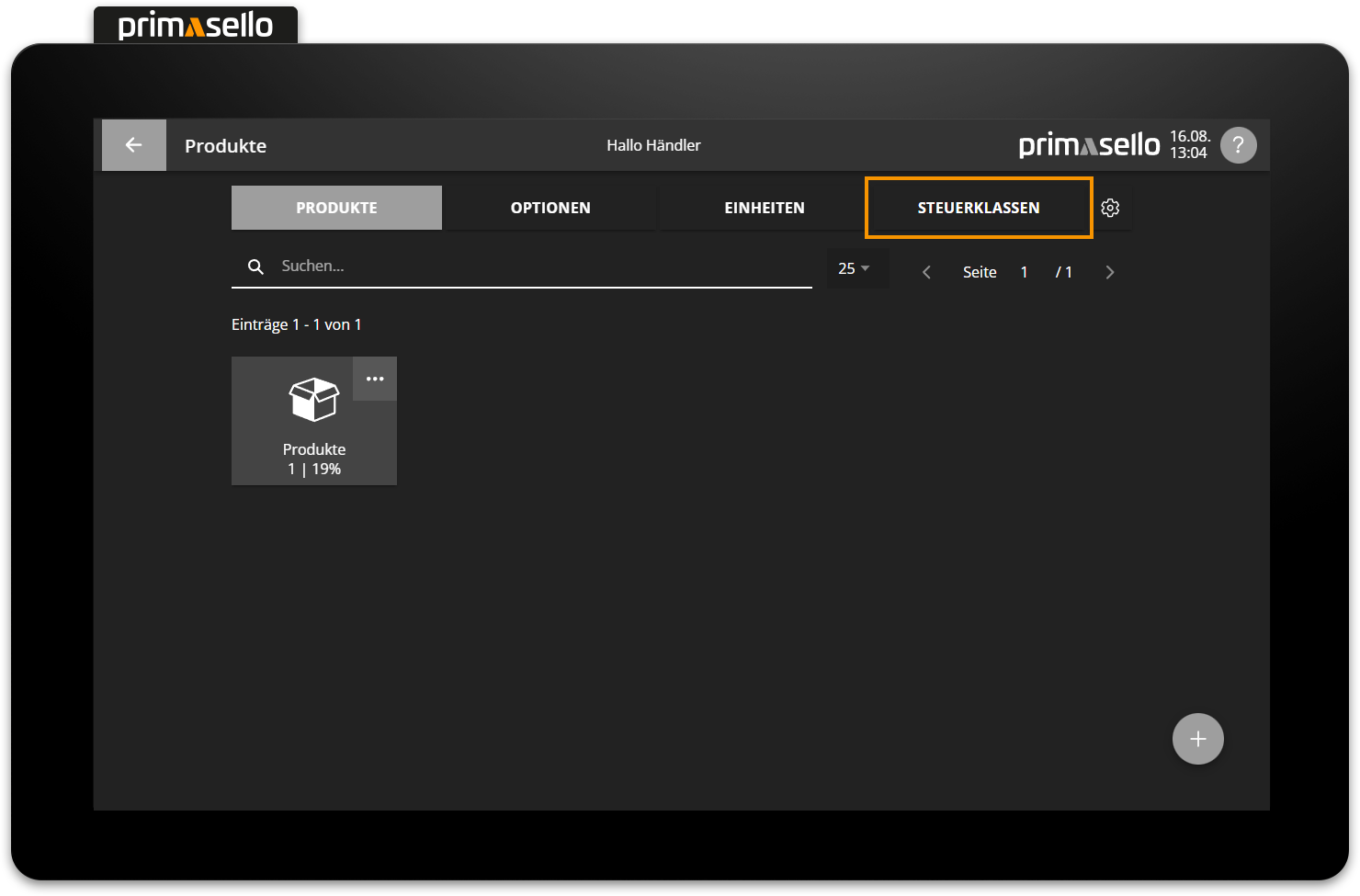

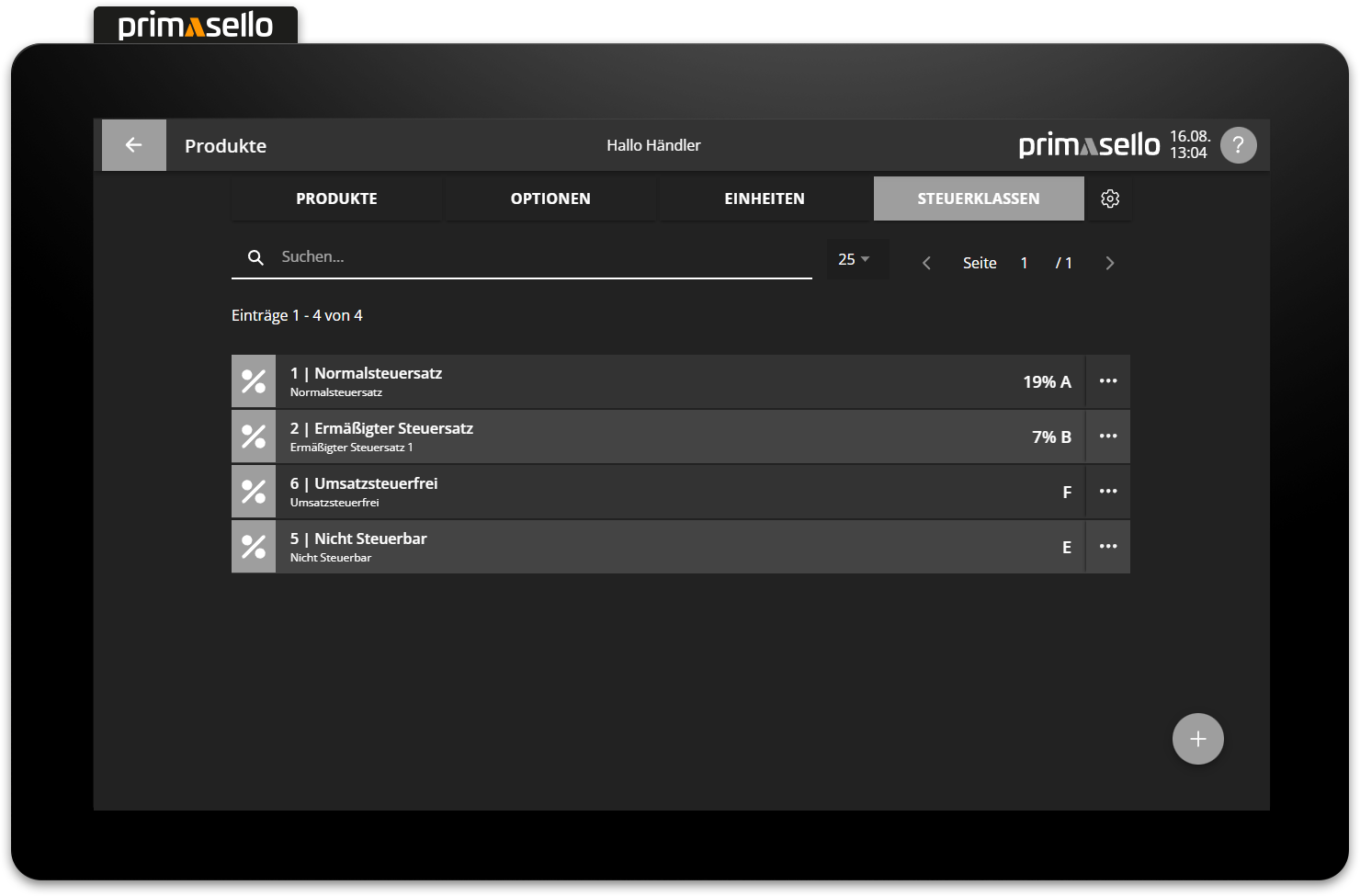

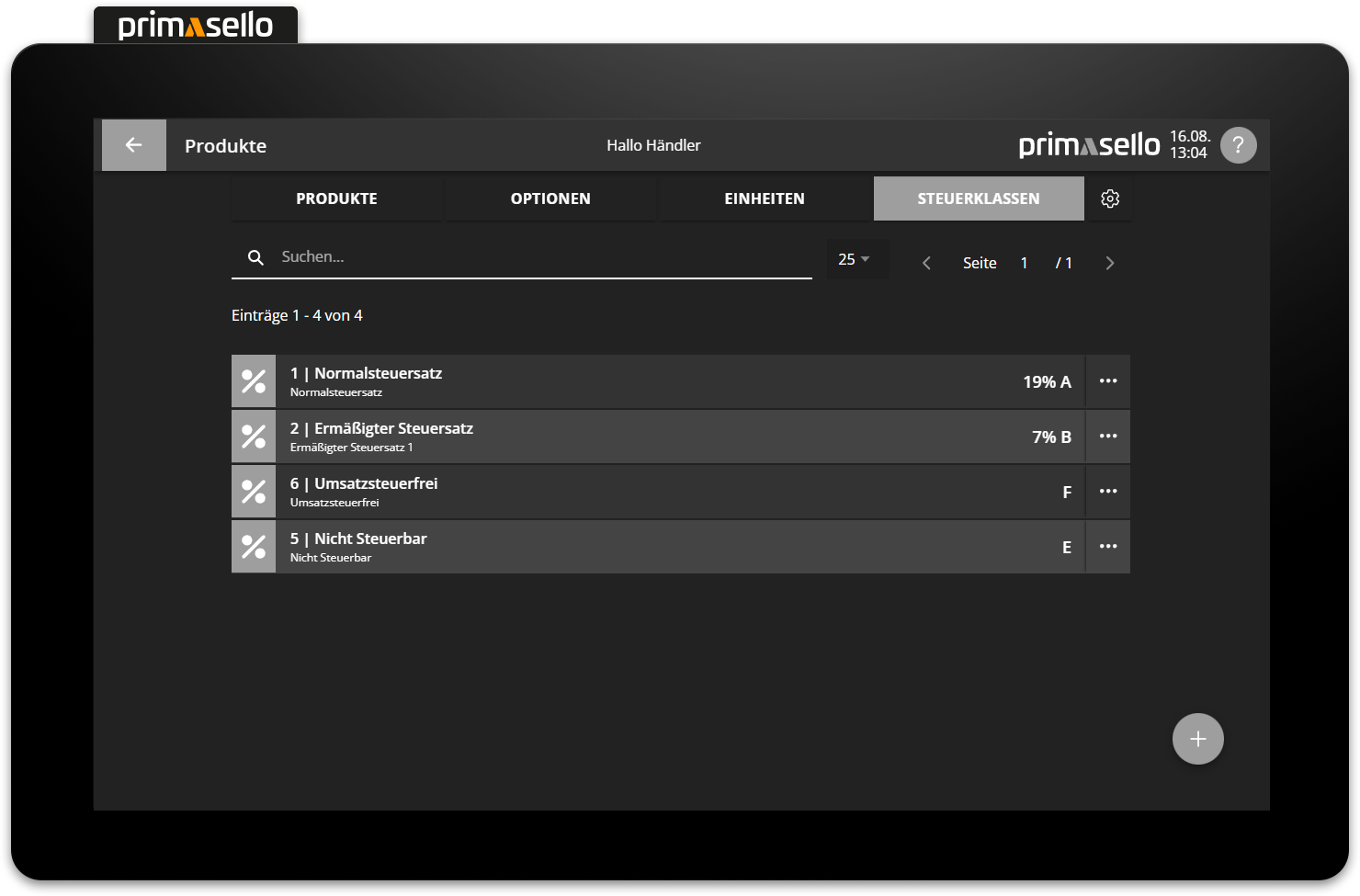

The tax classes can be accessed in the main menu in the ‘Master data’ section via the “Products” button and then in the ‘Tax classes’ tab.

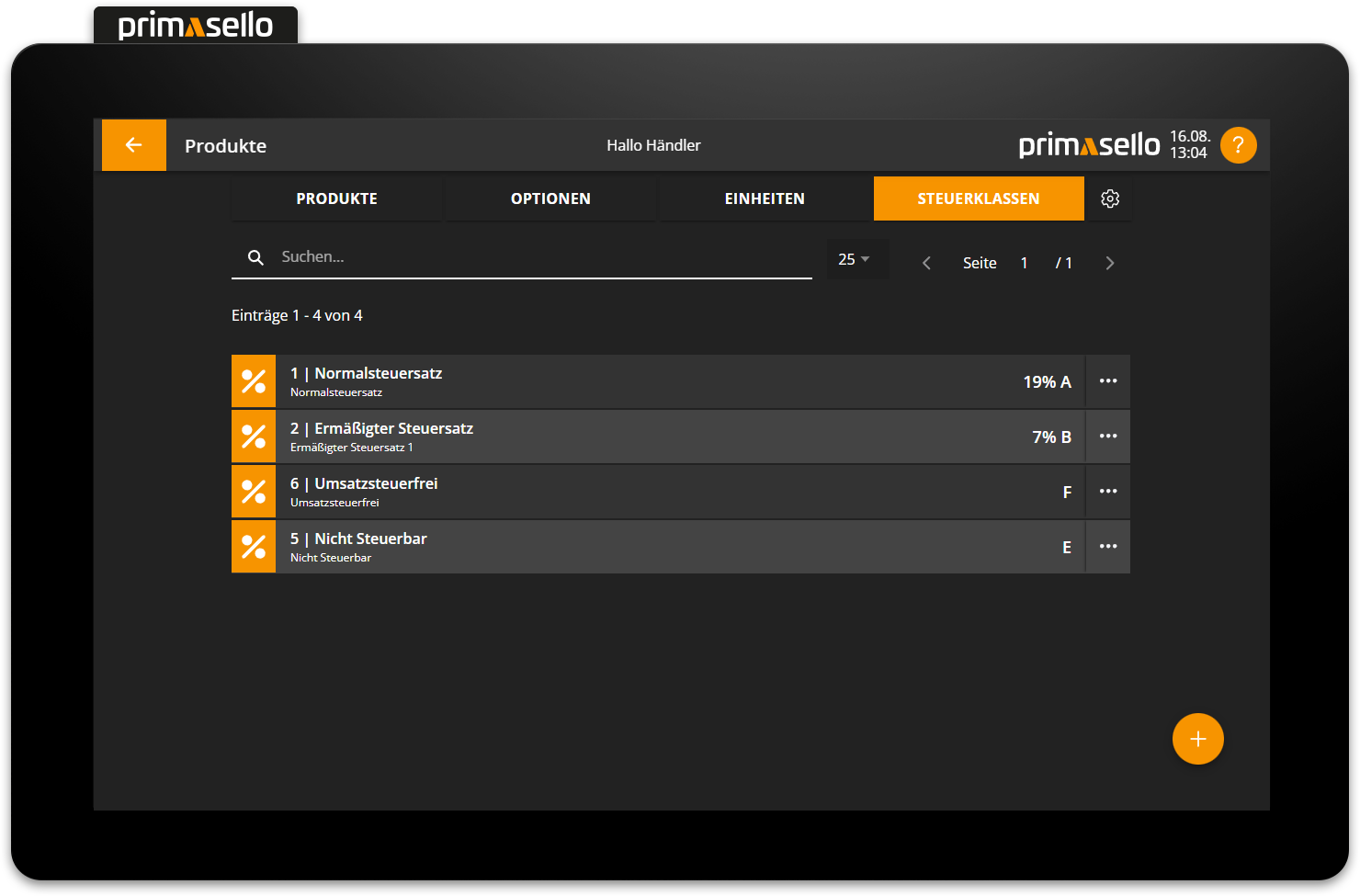

There are several standard tax classes that are automatically created by the system. The tax rates are adjusted accordingly depending on the country selection. A list of all tax classes to be used can be found at the end of this chapter.

Create new tax class

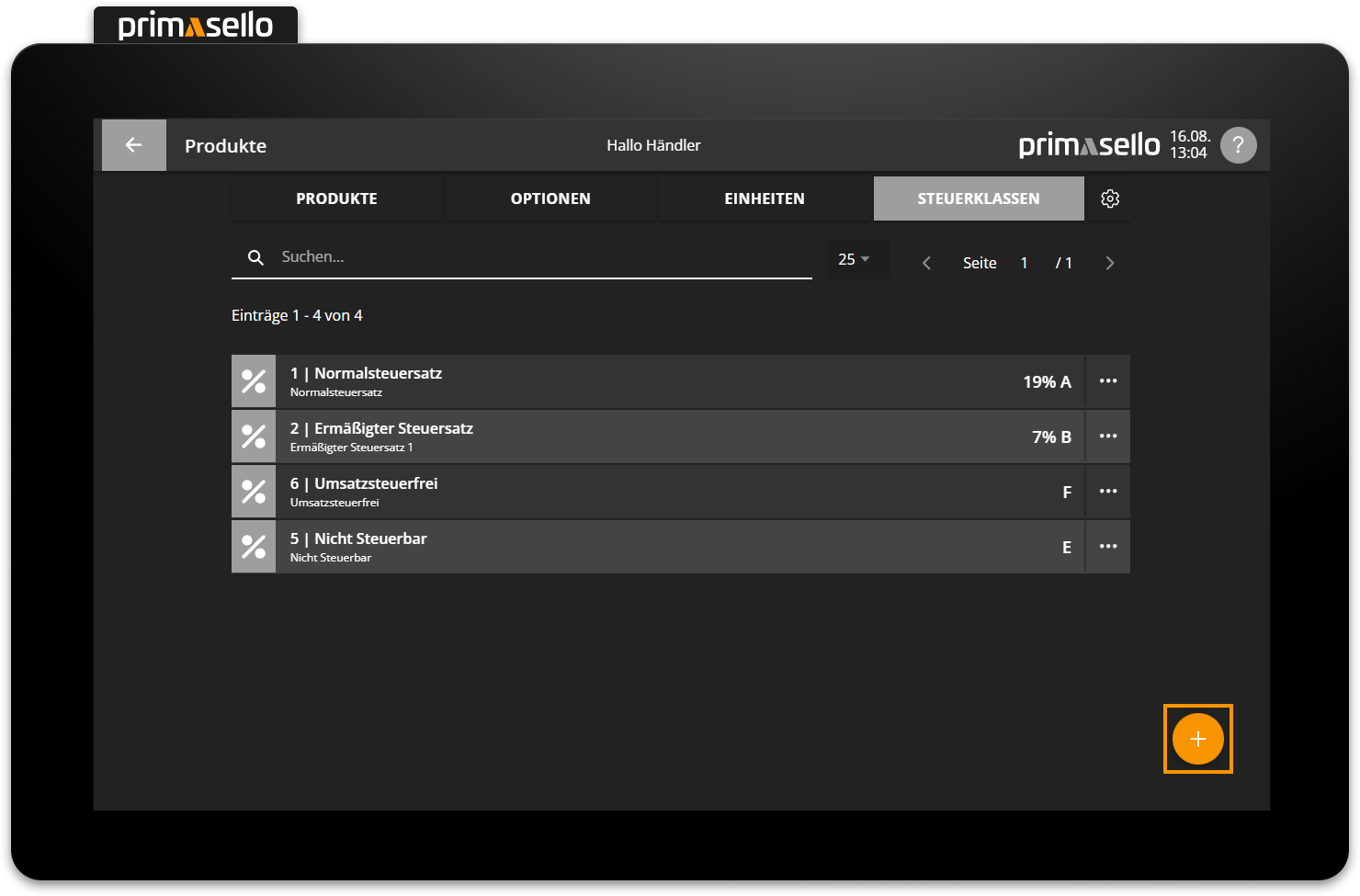

In the list view of tax classes, you can press the orange ‘plus’ button at the bottom right of the screen to create a new tax class.

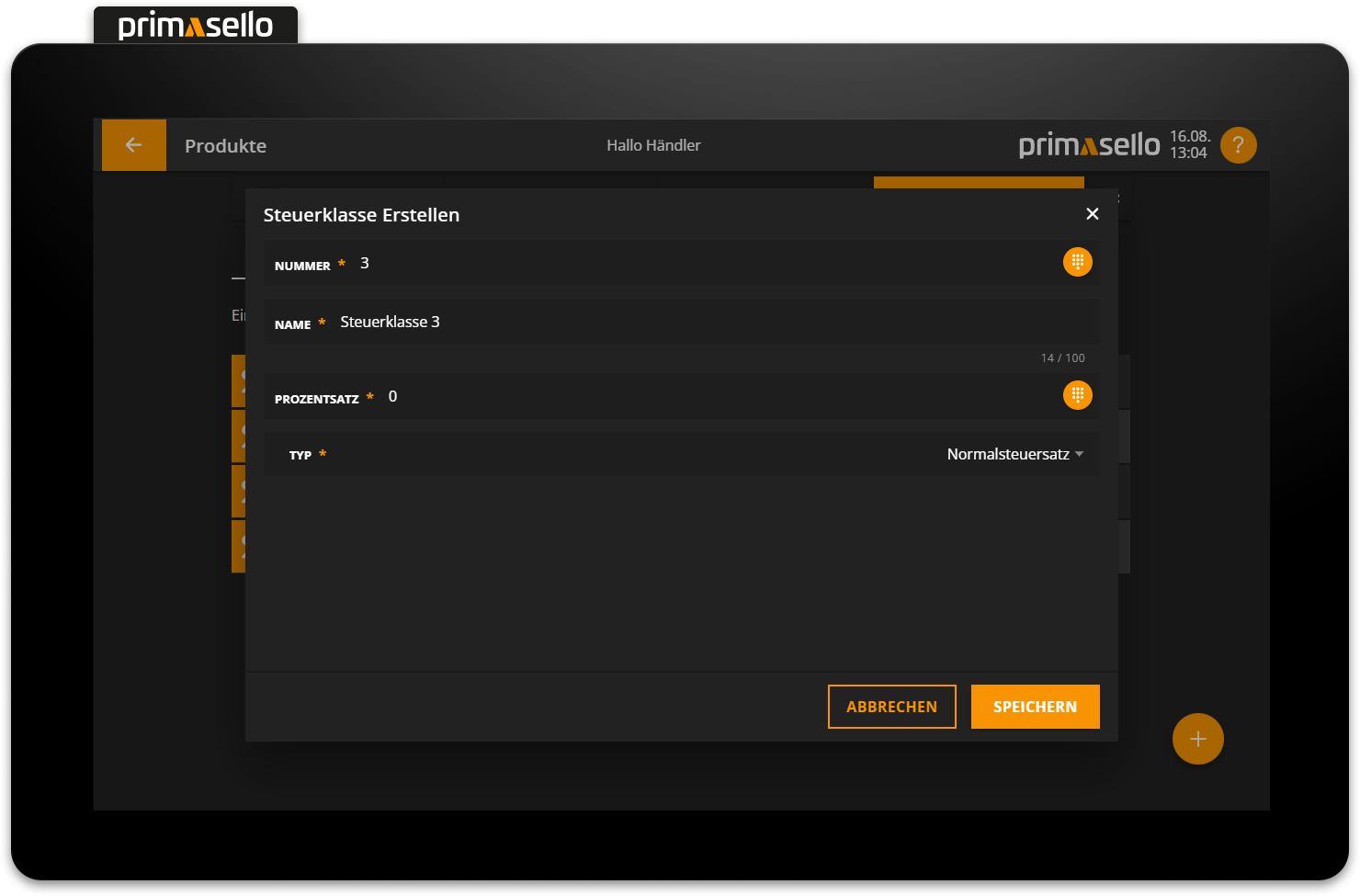

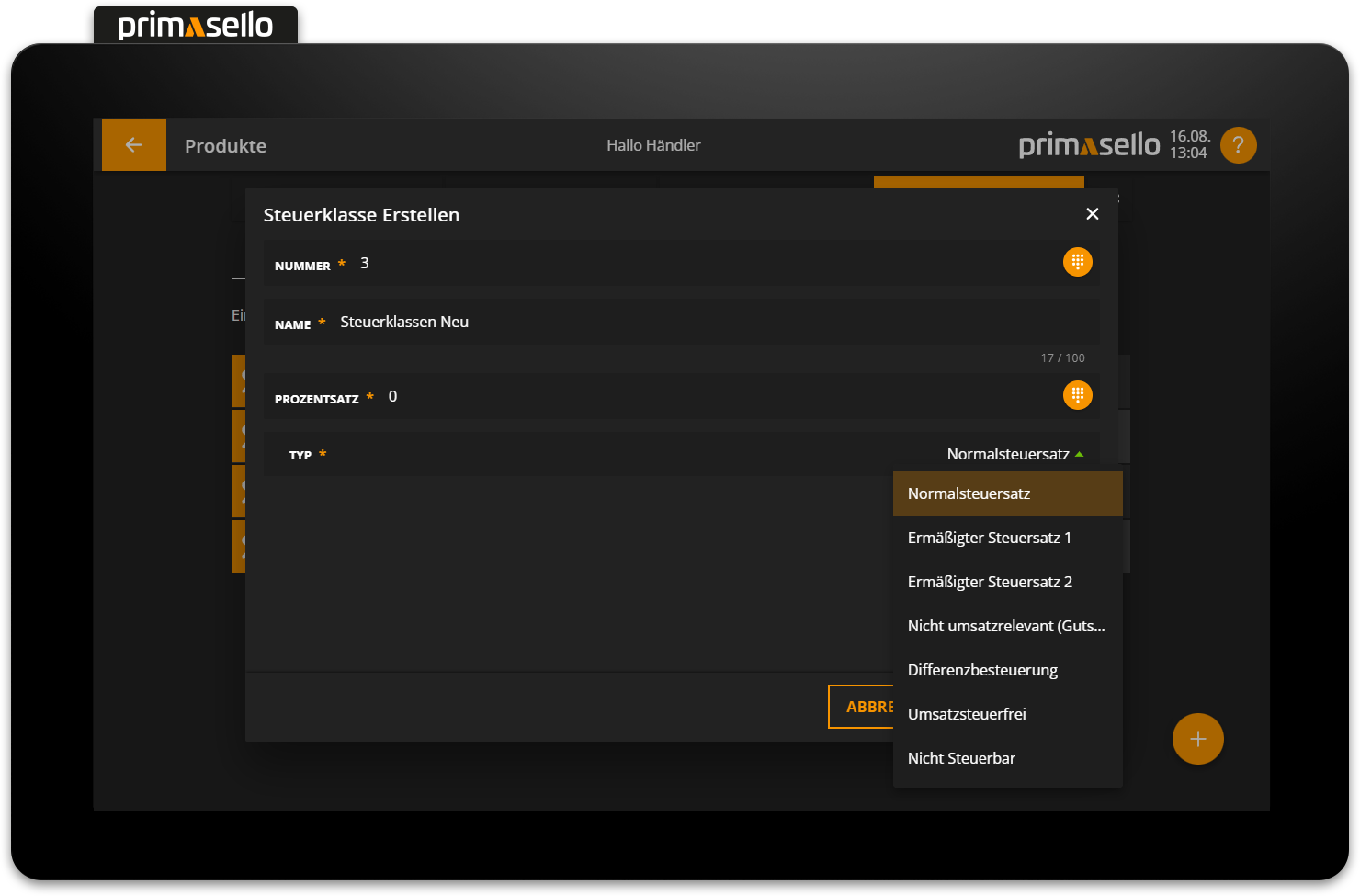

A separate window will open with information about the new tax class. All fields are automatically pre-filled and can be edited by clicking on them.

The tax class is assigned the next higher number that has not yet been used. Any numbers from 1000 onwards can be used for new individual tax classes. A list of all tax classes to be used can be found at the end of this chapter. By clicking on the name field, you can give the tax class a name.

Enter the percentage value for the new tax class in the percentage field. There are six options available for the tax class type:

Standard tax rate

Reduced tax rate 1

Reduced tax rate 2

Not relevant to sales (voucher, transitory item)

Differential taxation

VAT free

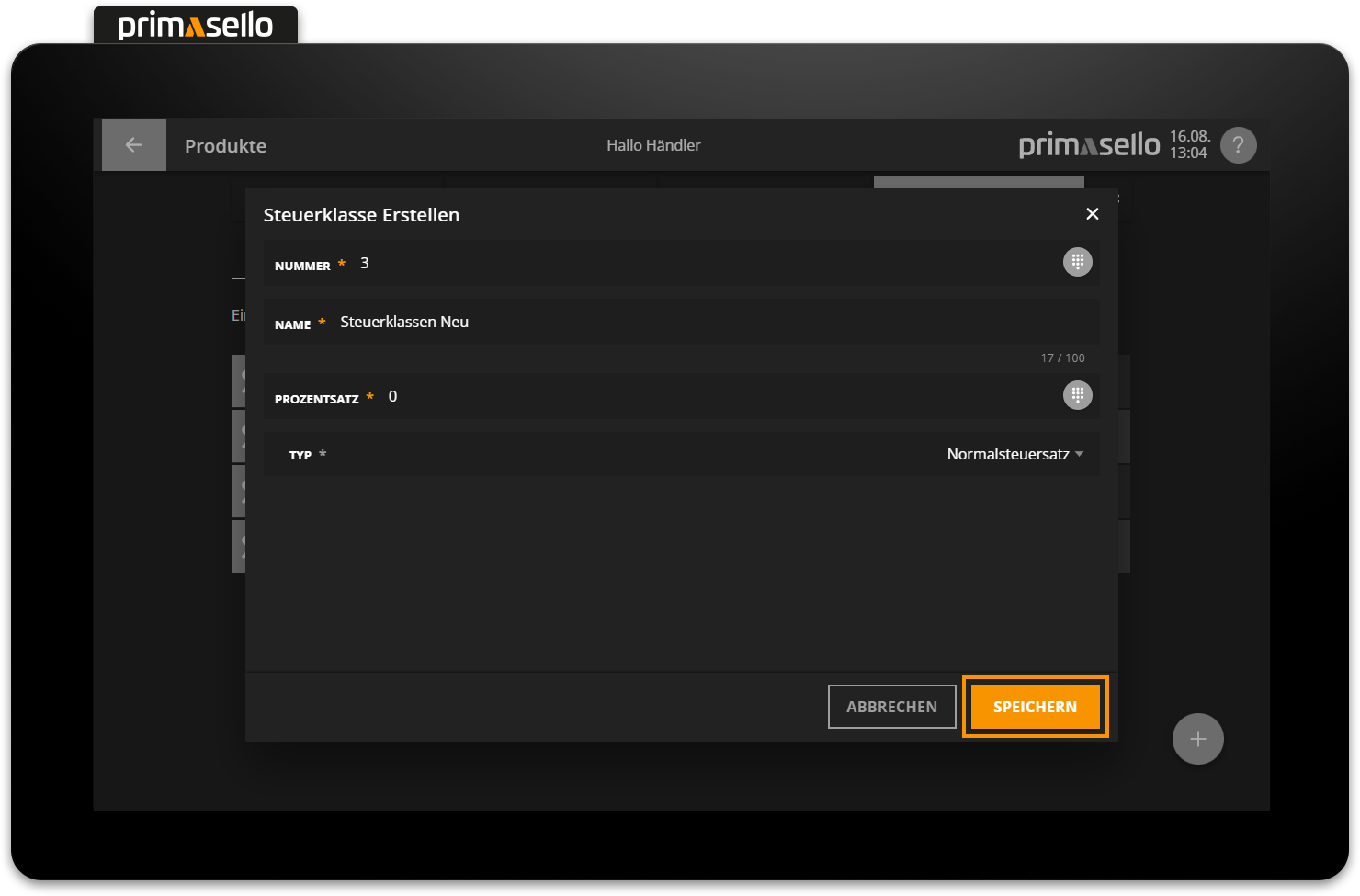

Pressing the orange ‘Save’ button in the lower right corner creates the new tax class and closes the window. Creating a new tax class can be cancelled by pressing the 'Cancel' button or the ‘x’ button in the upper right corner - all settings will be lost.

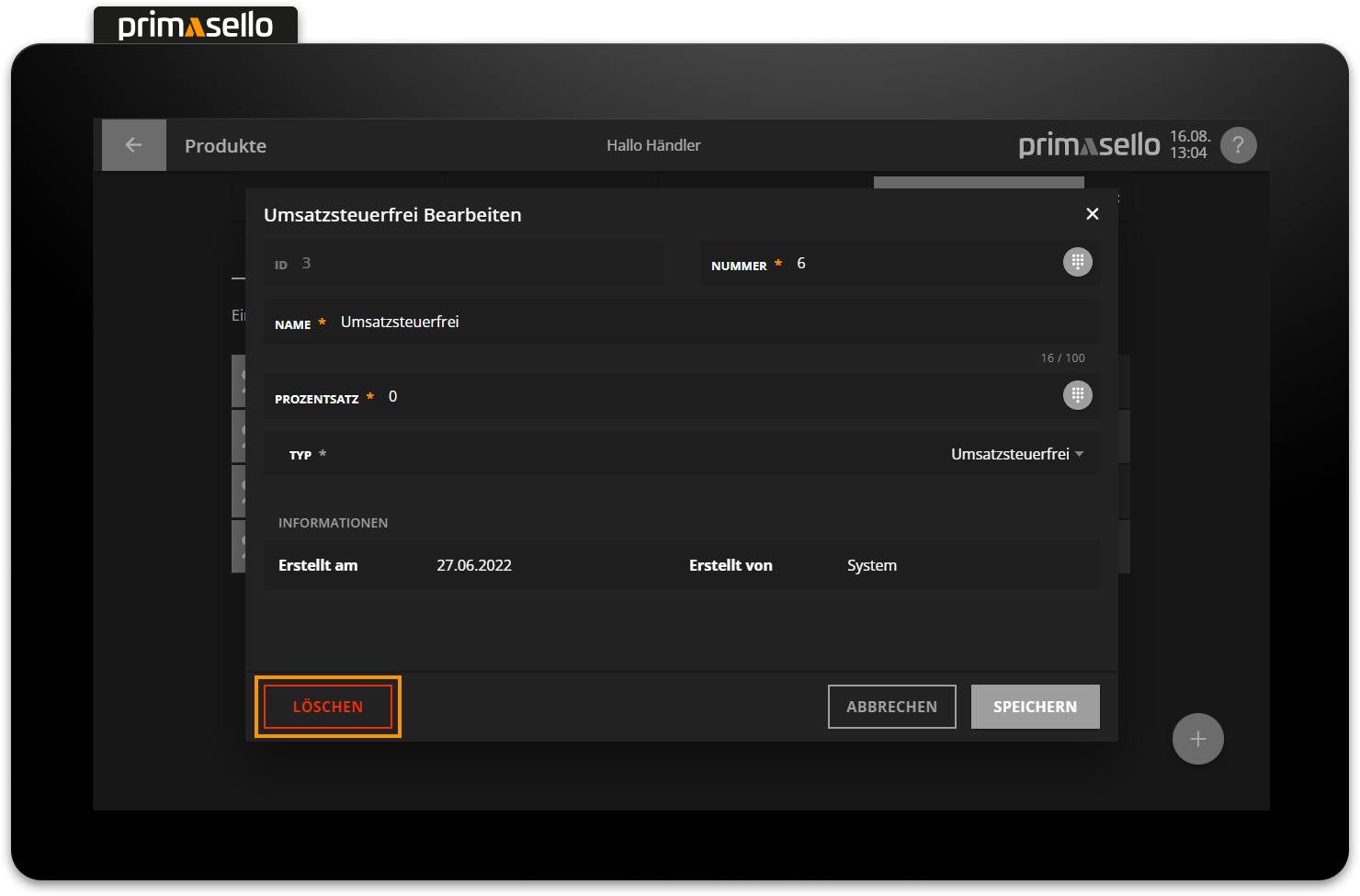

Edit tax class

To edit an existing tax class, press the relevant entry in the list. Alternatively, press the button with the three dots at the end of the line.

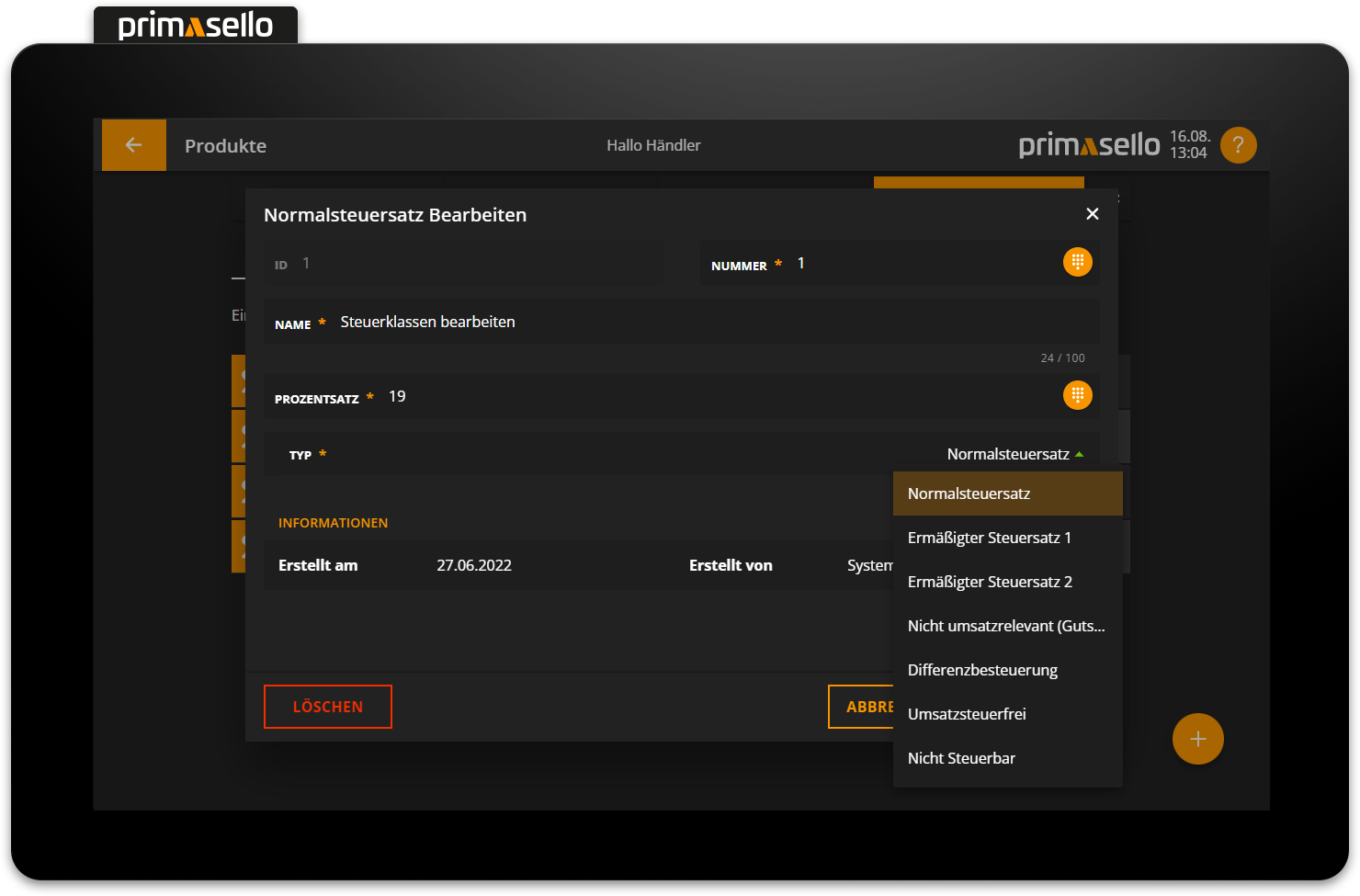

A separate window will open with information about the selected tax class. You can edit this by clicking on one of the fields.

Pressing the orange ‘Save’ button in the lower right corner applies the changes to the tax class and closes the window. Editing a tax class can be terminated by pressing the 'Cancel' button or by pressing the ‘x’ button in the upper right corner – all changes will be lost.

Delete tax class

To delete a tax class, select it from the list to open the detail window for the desired tax class.

The red "Delete" button is located in the bottom left-hand corner.

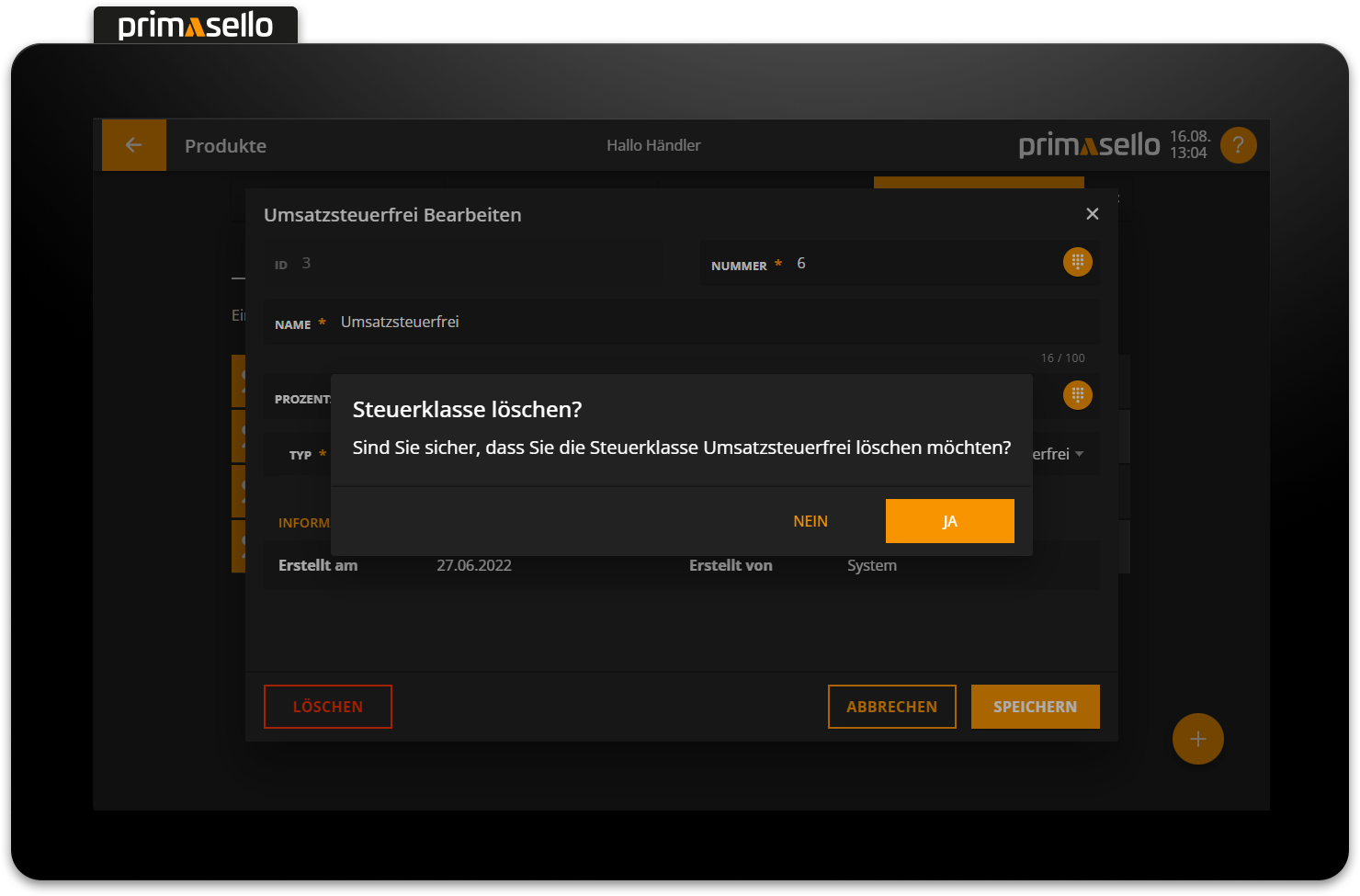

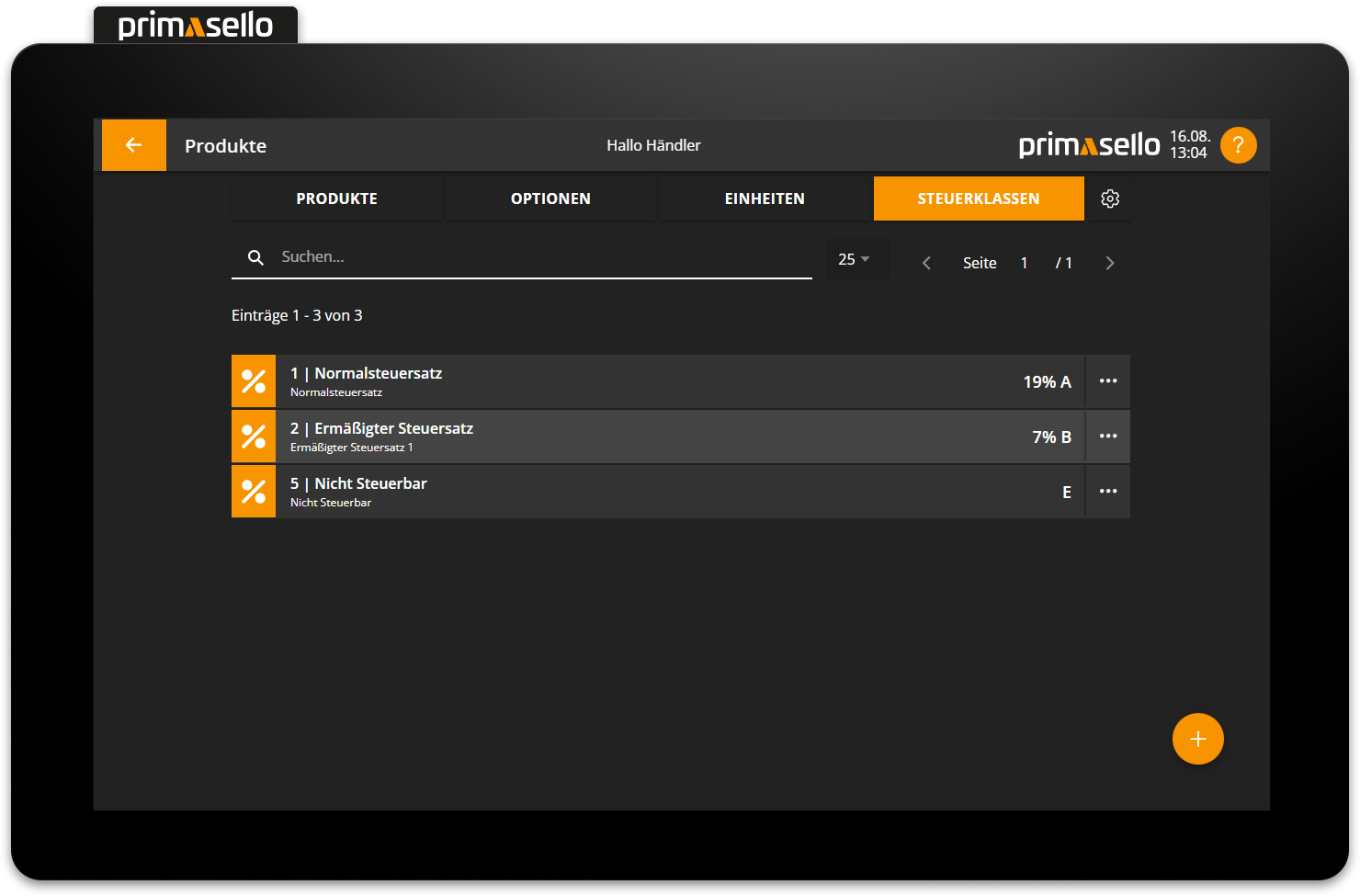

When this button is pressed, a security prompt appears, which must be confirmed with the ‘Yes’ button. The tax class is then deleted and the window closed. To cancel the deletion process, press the ‘No’ button.

Products & Product Groups

Tax classes that are used by products or product groups cannot be deleted. All products or product groups must first be linked to a different tax class.

How products and product groups can be edited is described in the chapter Products & Product Groups.

Tax classes according to DSFinV-K

The following tax classes must be used according to German law:

Number | Tax class | Description |

|---|---|---|

1 | General tax rate applicable at the time the transaction is recognised | |

2 | Reduced tax rate applicable at the time of recording the business transaction | |

3 | Average rate applicable at the time of recording the business transaction | |

4 | Average rate applicable at the time of recording the business transaction | |

5 | 0,00% | Not taxable |

6 | 0,00% | VAT-free |

7 | 0,00% | VAT not determinable |

8 | Reduced tax rate applicable at the time of recording the business transaction | |

11 | 19,00% | Historical general tax rate (Section 12(1) of the VAT Act) |

12 | 7,00% | Historical reduced tax rate (Section 12(2) of the VAT Act) |

13 | 10,70% | Historical average rate pursuant to Section 24(1) sentence 1 no. 3 of the German VAT Act (VAT Act) |

21 | 16,00% | Historical general tax rate (Section 12(1) of the VAT Act) |

22 | 5,00% | Historical reduced tax rate (Section 12(2) of the VAT Act) |

23 | 9,50% | Historical average rate in accordance to Section 24(1)(3) of the German VAT Act |

bis 999 | reserved for changes DSFinV-K | |

ab 1000 | individual circumstances (Section 13b of the German VAT Act, etc.) |

Current tax rates (key date 01.01.2023)

Number | Tax rate |

|---|---|

1 | 19,0% |

2 | 7,0% |

3 | 9% |

4 | 5,5% |

8 | 0% |

Error messages

The following error messages may occur. The error messages are always displayed next to the affected input field. The field and the message are highlighted in red.

Error message | Meaning | Solution |

|---|---|---|

This number already exists. | The product group number or item number of the product is already stored for another product. | Check the number and assign a different one. |

Maximum input exceeded. | The input may only have a certain character length. The maximum length is displayed at the end of the line (e.g. 13 / 100). | Shorten the input to the maximum value. |

Maximum percentage value exceeded. | Only numbers between 0 and 100 can be selected for percentage values. The entry cannot be higher than 100%. | Check the percentage value and repeat the entry. |