Dine in / Takeaway

In the gastronomy sector in particular, different tax classes are used for products depending on whether the order is consumed on site or taken away. With the ‘dine in/takeaway’ function, you can switch between the dine in tax class and the takeaway tax class for products.

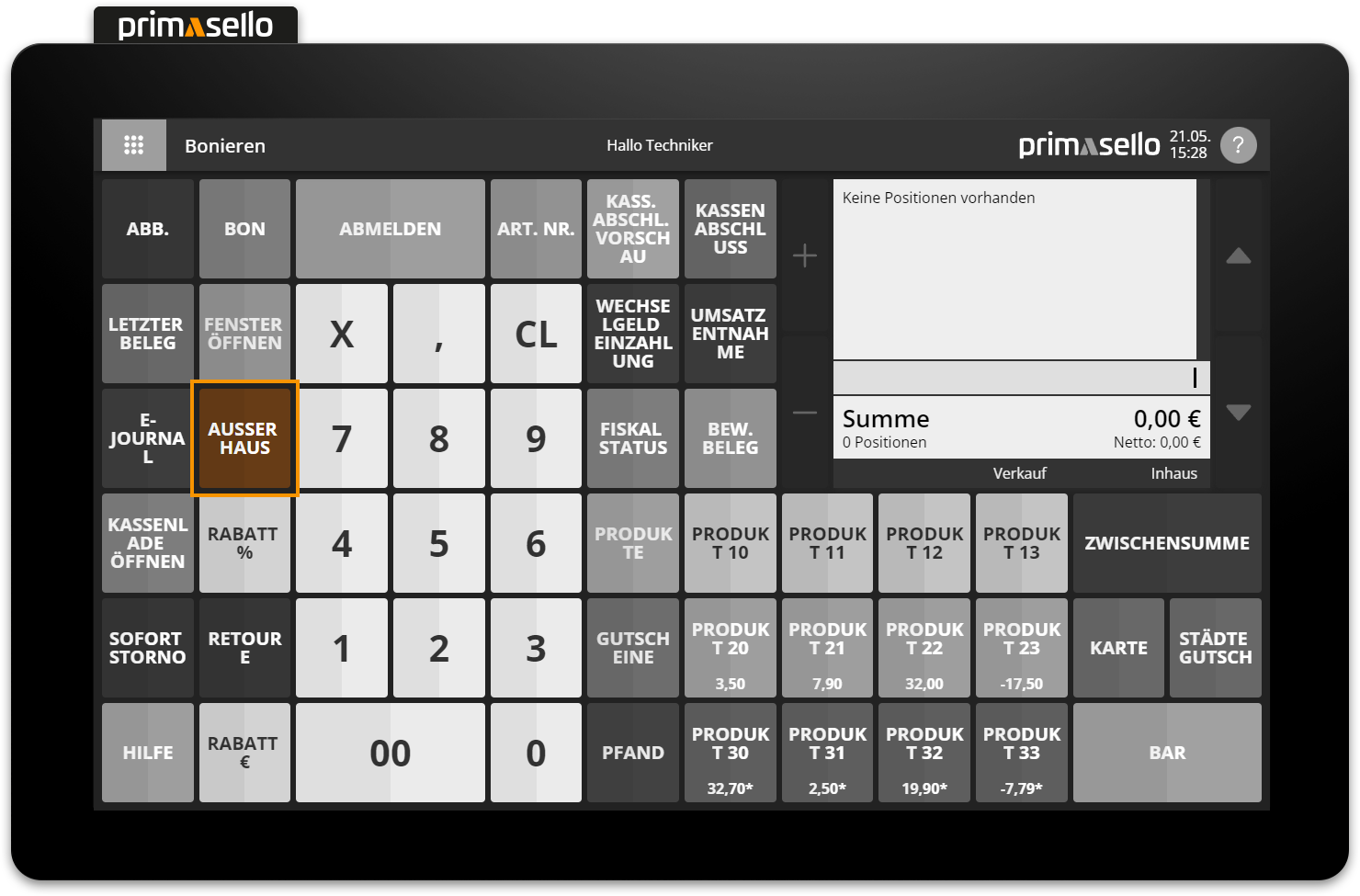

Depending on the business model, the programming can be set to determine whether food and drinks are consumed on site (dine in) or “takeaway” by default. The button on the register interface switches to the other option accordingly. This documentation assumes that products are consumed on site (dine in) by default and that the function button switches to the 'takeaway' option.

Products & product groups

To use this function, alternative tax classes have to be stored for product groups or products. How to set tax classes is described in the chapter Managing Products.

How to activate the ‘takeaway’ function in the programming is described in the chapter Dine in / Takeaway Function.

Switch between dine in and takeaway

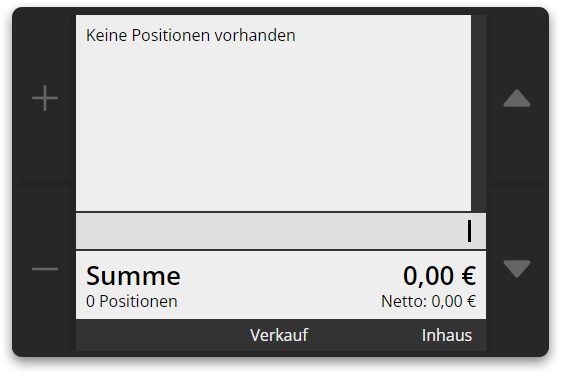

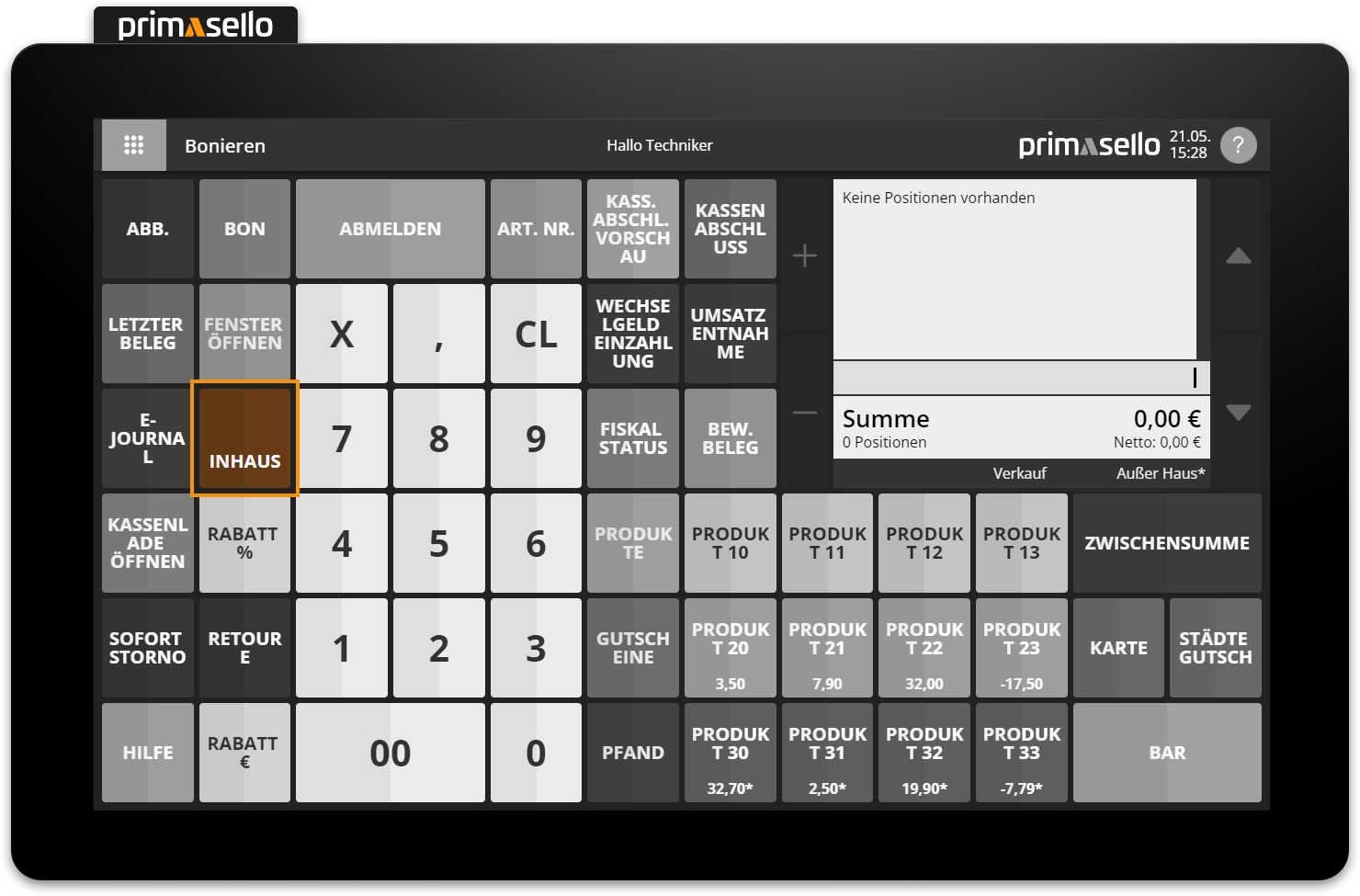

When the ‘Dine in/Takeaway’ button on the register interface is pressed, the tax rate for all products changes to the alternative second tax class. The button changes its appearance and now displays a back arrow and the other option below it. Depending on the selection, 'Takeaway' or ‘Dine in’ is displayed in the mode bar on the right-hand side of the shopping cart.

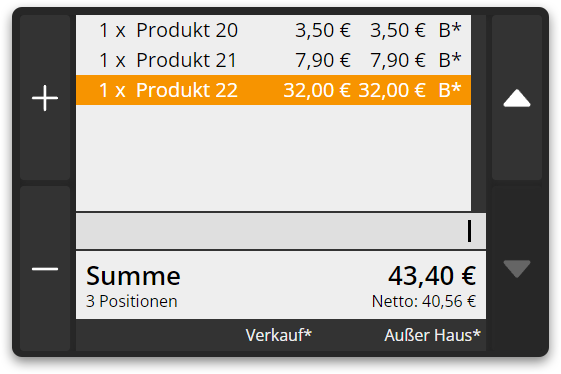

With this function, it does not matter whether there are already items in the shopping cart or whether you are just starting to register products. You can switch between ‘dine in’ and 'takeaway' for each item individually. As soon as you press the ‘Dine in / Takeaway’ button, the tax class is changed for all items that are newly added to the shopping cart.

To return to registering with the normal tax class, press the ‘Dine in/Takeaway’ button with the back arrow again. Depending on the programming, the register will now return to the mode defined as default. All items added to the shopping cart after this will be registered at the default tax rate.

Items added to the shopping cart at the alternative tax rate are marked with an asterisk * after the tax code.

Close receipt

If an receipt is completed with ‘dine in’ and ‘takeaway’ items, the receipt will be printed with the different tax labels as usual. The gross prices of the products remain the same. The receipts created are stored in the electronic journal and the items with alternative tax rates are marked with an asterisk * after the tax code.

Close receipts

How to close a receipt is described in the chapter Close receipts.